this post was submitted on 01 Aug 2024

720 points (100.0% liked)

196

16566 readers

2195 users here now

Be sure to follow the rule before you head out.

Rule: You must post before you leave.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

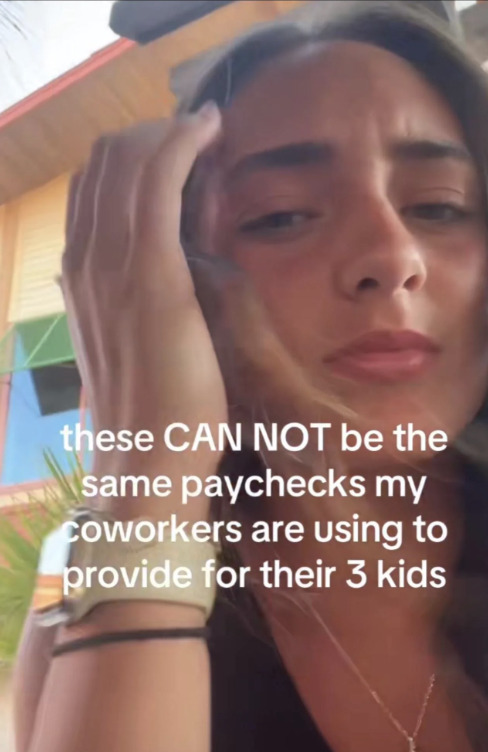

I often wonder similarly. comes down to double income. We went from families being raised on 40 hours a week labor to 100 or more.

Yup. Something to remember whenever Forbes or WSJ publishes some feel-good article about how, "household income is keeping up with inflation."

What they don't mention is the "household" now includes everyone except the family dog. And even with everyone working, the quality of life continues to decline.

As someone currently raosong 2 kids on a single fairly meager income, it comes down to budgeting, extreme price sensitivity and using the annual child tax credits as a cash injection to rebalance everything every 12 months and/or subsidize major needed purchases

imagine if that credit was removed due to certain politicians who respond with people need to budget better and bootstrap and crap.

Politicians should have to live on the federal minimum wage. Their jobs and staff can be managed by an office manager. Any personal wealth has to go into a blind trust so there's no cheating.

Let's see how fast that wage comes up.

A trump presidency would be the beginning of the end. Republicans want complete control because they need it inact their cruel policies. When the common folk are on the streets hungry, the rich start to look awfully appetizing.

Don’t worry rich people, the police will get a wage increase to keep those hungry beggars away from you.

I'd be more concerned about that if I were looking at my current economic situation continuing for the long term, but realistically once both kids are in school (which might happen within 12 months even!) my wife can start working, plus I haven't reached the coasting phase of my career yet, so I have plenty of opportunity to increase me income.

This year's tax credit will be paying off the last of the nasty debt accrued from my wifes various jobless phases before I went back to college and started making just enough that she didn't need to work anymore, so that'll be $200ish/mo back in our pockets to start building a proper emergency fund then figure it out from there. Plus my special needs child should have Medicaid very soon which will be another $200ish/mo back in our pockets as well given his very expensive appointments that had us to hit the deductible before March

Glad I'm not alone in this. Tight budgeting that slowly trickles down to negative and then the tax credits come in and give us a boost to hopefully last the next year.