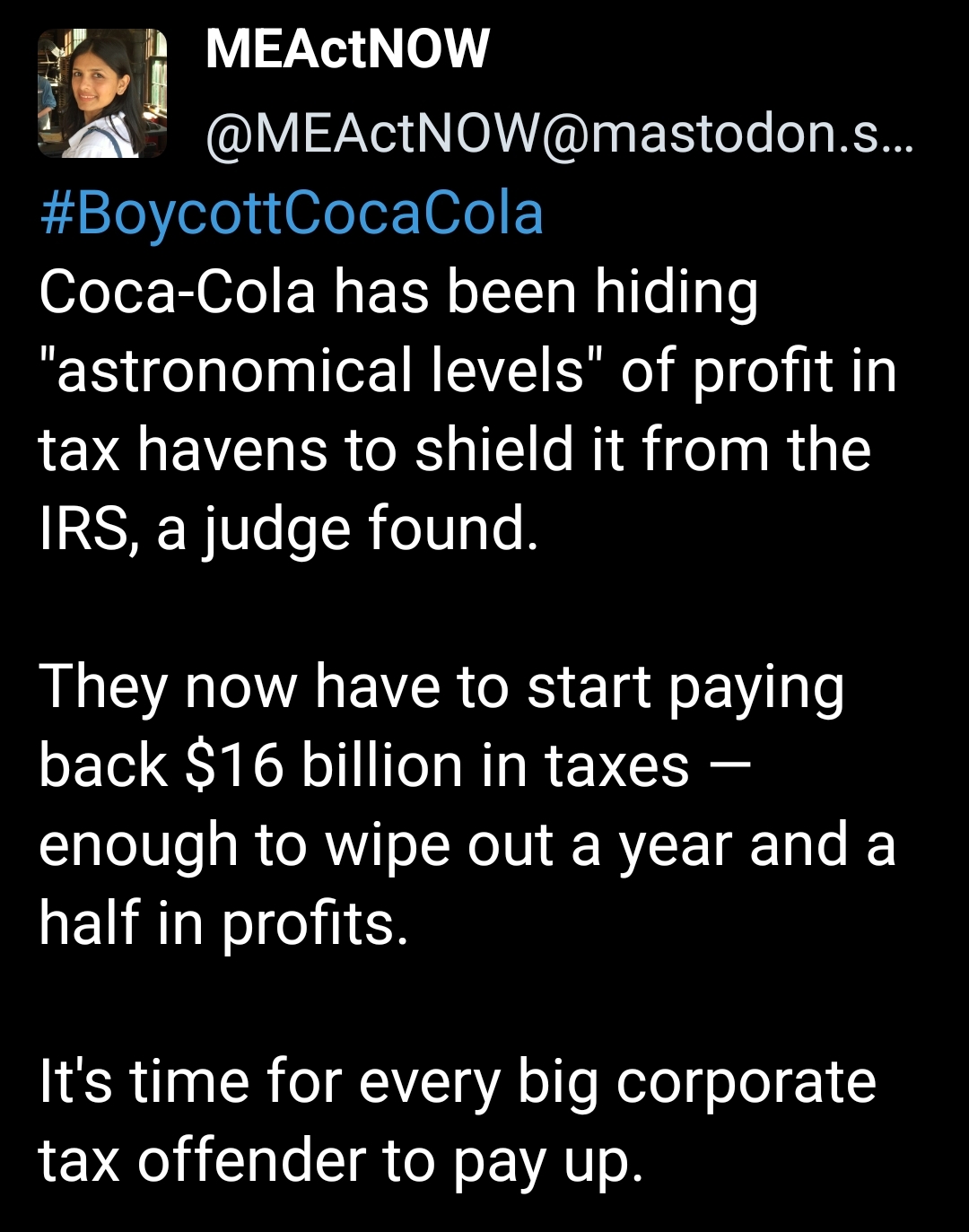

With a wink and a nudge, transactions are often structured to shift profits from high-tax countries to low-tax countries to cut their tax bills. The most popular target for transfer pricing abuse is intangible property, including licenses for manufacturing, distribution, sale, marketing, and promotion of products in overseas markets. Since intangible property doesn't really have a physical home—unlike, say, real estate—it's easy to transfer it to countries that offer certain benefits, including more favorable tax treatment. (That’s what’s in dispute in the Coca-Cola case.)

Ugh