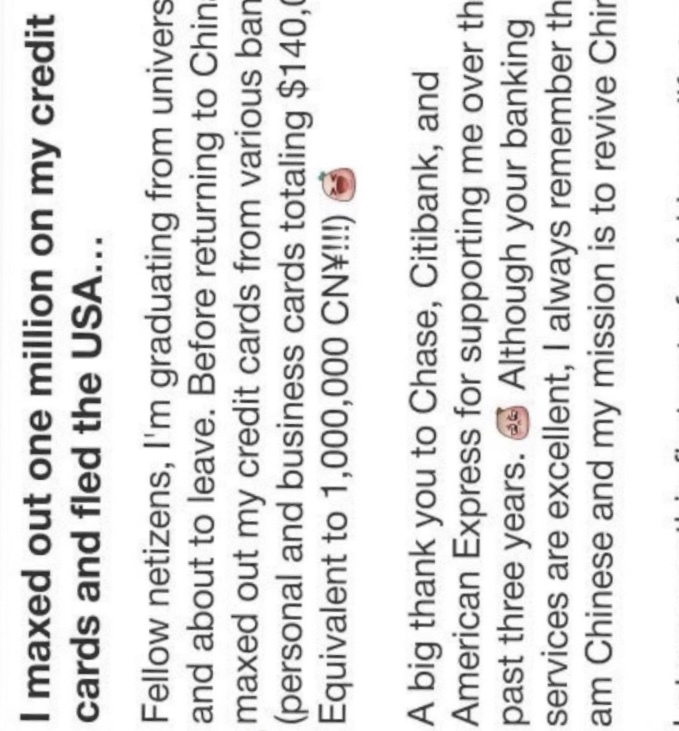

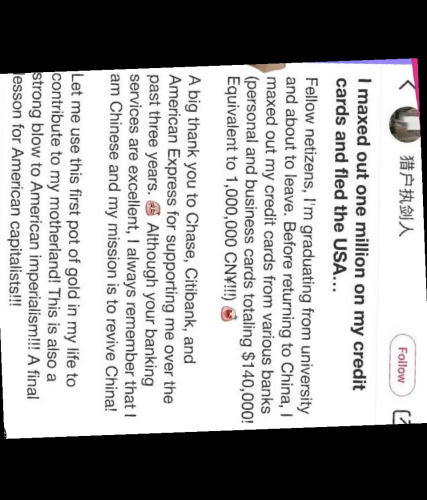

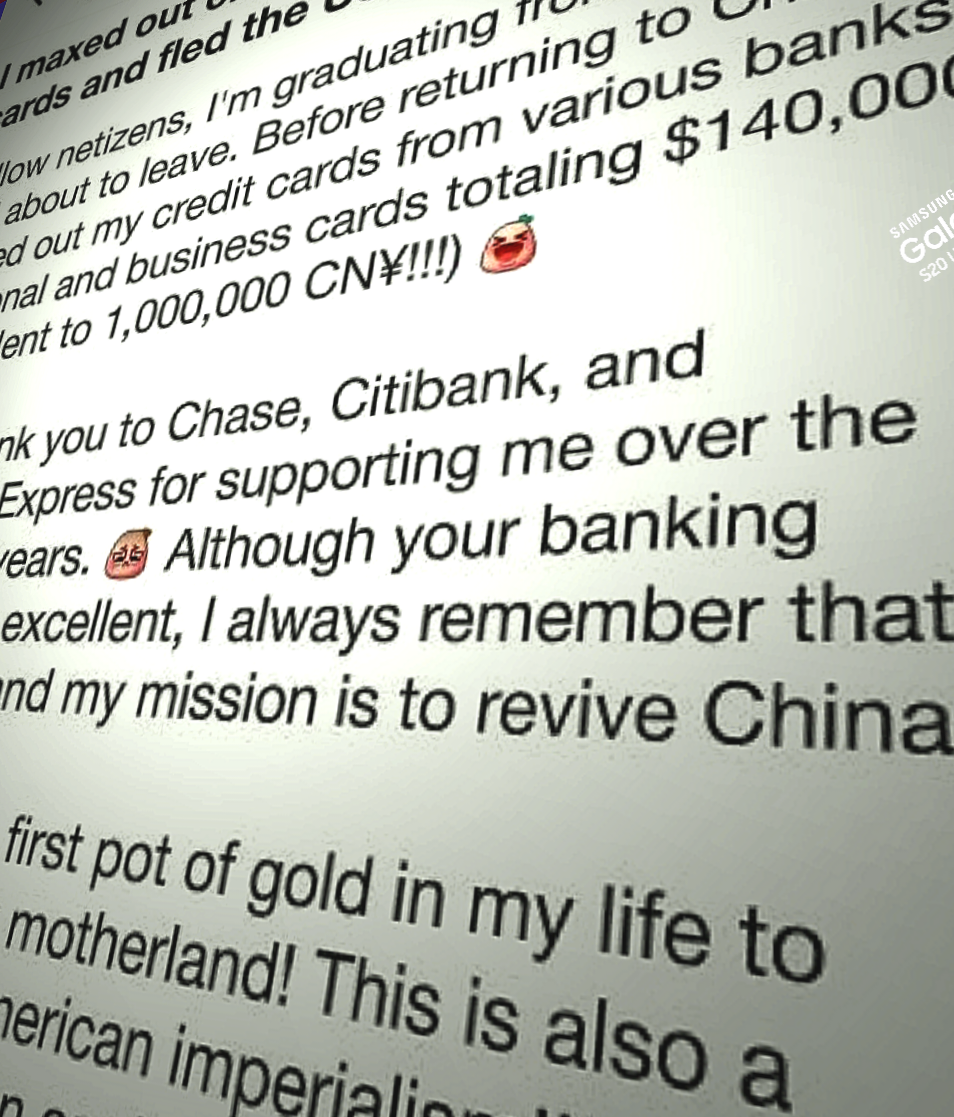

This is kinda funny, but extremely fake. I'm a second generation immigrant. I can attest that obtaining a credit card without citizenship is basically impossible, and very difficult even with a green card.

Also, when people from Asia travel they usually have dual currency credit cards that work very well in their country and the west. All the major financial organizations have offices in China. Hell you can get a dual currency card from the bank of China in MasterCard or Visa.