It's a low amount though (2000*36=€72k). What is more concerning is his 50,610 shares that he sold in total in the past year, as now that is a fairly big amount if he planned this move many months ago.

To be fair, these guys are much more suspicious:

Chief among them being Tomer Bar-Zeev, Unity’s president of growth, who sold 37,500 shares on September 1 for roughly $1,406,250, and board director Shlomo Dovrat, who sold 68,454 shares on August 30 for around $2,576,608.

EDIT:

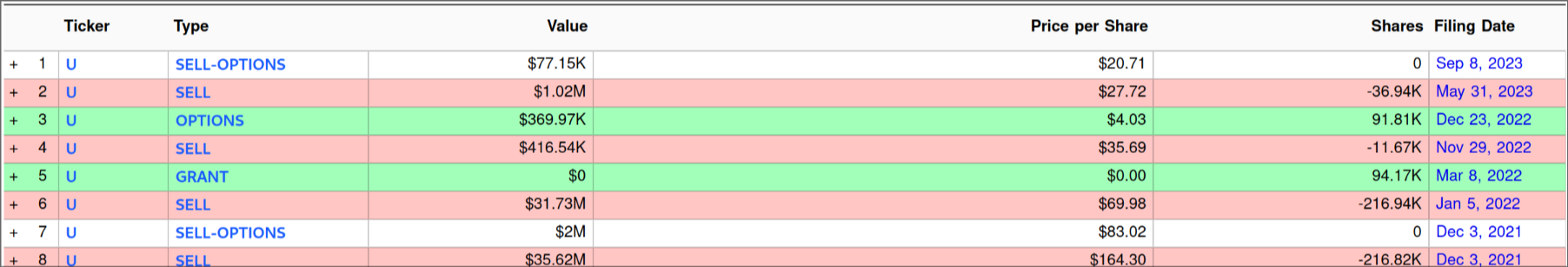

Yeah, nothing really unusual in Riccitiello's trades. He may be an asshole but that's no reason to immediately accuse him of insider trading for a lousy $77.15k worth of shares given that he already has a pattern of selling way bigger amounts:

EDIT 2:

Here's Riccitiello's filing for that trade: https://www.secform4.com/filings/1810806/0001810806-23-000163.htm

Read in particular this part:

( 2 )The sales reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by the Reporting Person on May 19, 2023.

That's not insider trading. That's a pre-planned trade (see Investopedia's entry about Rule 10b5-1) that would have been executed no matter what.