a new 90% tax on any annual income above €400,000

Lmao. Probably not gonna happen but based af

A community for discussing events around the World

Rule 1: posts have the following requirements:

Rule 2: Do not copy the entire article into your post. The key points in 1-2 paragraphs is allowed (even encouraged!), but large segments of articles posted in the body will result in the post being removed. If you have to stop and think "Is this fair use?", it probably isn't. Archive links, especially the ones created on link submission, are absolutely allowed but those that avoid paywalls are not.

Rule 3: Opinions articles, or Articles based on misinformation/propaganda may be removed. Sources that have a Low or Very Low factual reporting rating or MBFC Credibility Rating may be removed.

Rule 4: Posts or comments that are homophobic, transphobic, racist, sexist, anti-religious, or ableist will be removed. “Ironic” prejudice is just prejudiced.

Posts and comments must abide by the lemmy.world terms of service UPDATED AS OF 10/19

Rule 5: Keep it civil. It's OK to say the subject of an article is behaving like a (pejorative, pejorative). It's NOT OK to say another USER is (pejorative). Strong language is fine, just not directed at other members. Engage in good-faith and with respect! This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban.

Similarly, if you see posts along these lines, do not engage. Report them, block them, and live a happier life than they do. We see too many slapfights that boil down to "Mom! He's bugging me!" and "I'm not touching you!" Going forward, slapfights will result in removed comments and temp bans to cool off.

Rule 6: Memes, spam, other low effort posting, reposts, misinformation, advocating violence, off-topic, trolling, offensive, regarding the moderators or meta in content may be removed at any time.

Rule 7: We didn't USED to need a rule about how many posts one could make in a day, then someone posted NINETEEN articles in a single day. Not comments, FULL ARTICLES. If you're posting more than say, 10 or so, consider going outside and touching grass. We reserve the right to limit over-posting so a single user does not dominate the front page.

We ask that the users report any comment or post that violate the rules, to use critical thinking when reading, posting or commenting. Users that post off-topic spam, advocate violence, have multiple comments or posts removed, weaponize reports or violate the code of conduct will be banned.

All posts and comments will be reviewed on a case-by-case basis. This means that some content that violates the rules may be allowed, while other content that does not violate the rules may be removed. The moderators retain the right to remove any content and ban users.

News [email protected]

Politics [email protected]

World Politics [email protected]

For Firefox users, there is media bias / propaganda / fact check plugin.

https://addons.mozilla.org/en-US/firefox/addon/media-bias-fact-check/

a new 90% tax on any annual income above €400,000

Lmao. Probably not gonna happen but based af

I think it's a great target to aim for. That's an unfathomable income to most people, so it should at least have popular support

It will not. People will vehemently defend the rich.

Some will, but there's an ever growing movement against gross wealth inequality. When simply buying groceries becomes a struggle for more and more people, that's usually a telltale sign that the working class is going to start getting angry at the insatiable greed of those at the top.

If there ever will be fight in line for bread, french will do french thing

Worked fine in America during it's "great" days that all these Trump voters seem to yearn for

Funny how they want to 'mAkE aMeRiCa GrEaT aGaIn' but don't want any of the policies that made America great, just the shitty racist ones that made life awful for non-white males. I'm just waiting for them to further limit it by land holding or wealth at some point..... Really take us back to when we were 'really great'

Love it. Wealthy in France is 200k, anyone who makes over 400k is uberwealthy

Yea 400k won’t happen, I could see something in the low millions being palatable to populace at large

"Radical set of ideas"

Rational set of ideas.

Radical means change or far from the norm, so when the system we live in is crazy then radical often is rational. The terms are not opposed.

a new 90% tax on any annual income above €400,000 (£337,954)

Sexy, but as other commenters mentioned before, taxing existing wealth is more sexy

That's true, but taxing wealth is significantly harder than taxing income or financial transactions (including inheritances).

Inflation is probably the easiest way to achieve that. You just have to be careful that wages rise along.

This type of taxation I would say is a version of the Ultimatum game. If the taxation is too high, they simply move and then you get nothing

https://en.m.wikipedia.org/wiki/Ultimatum_game

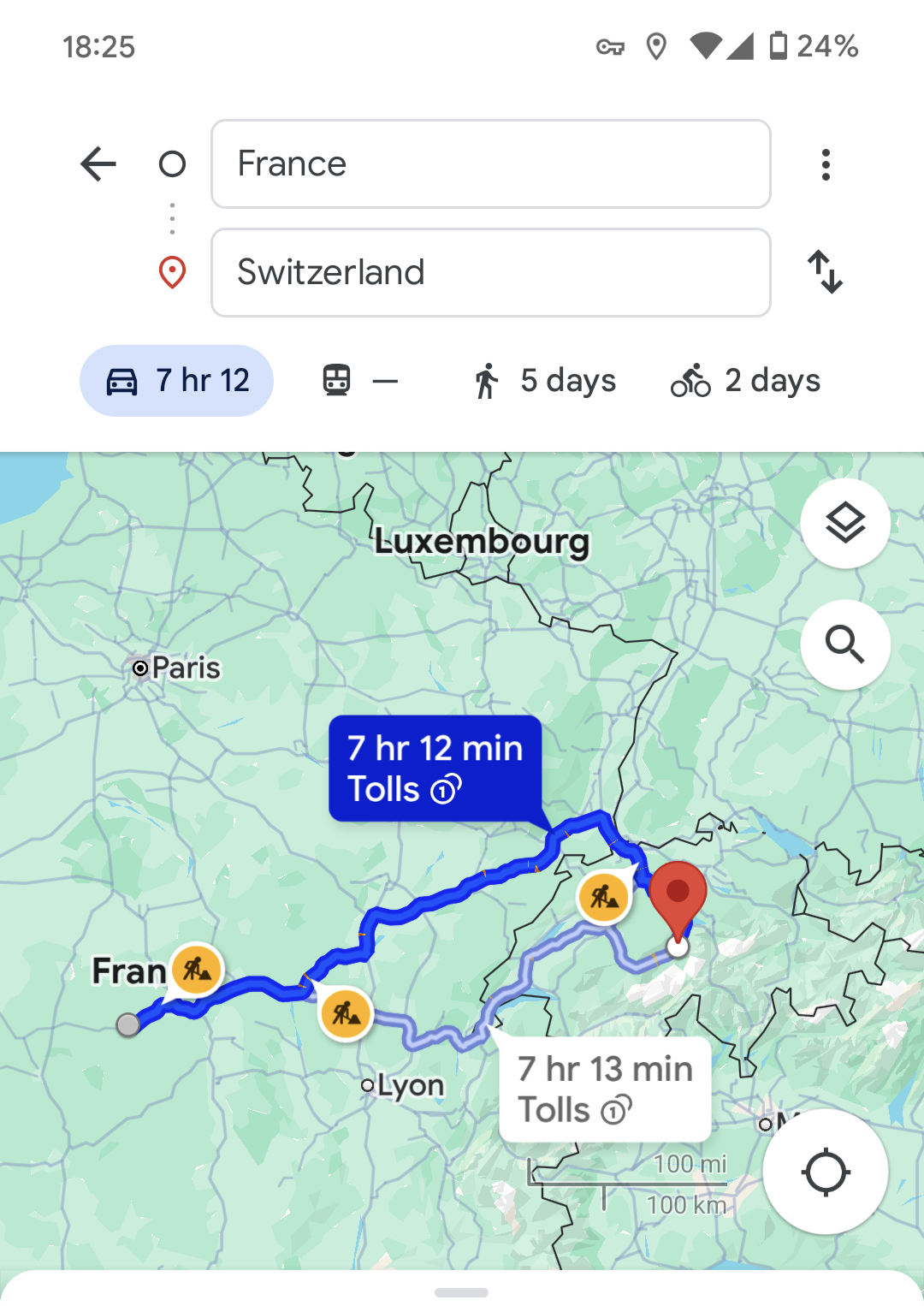

It has to be high enough, but not so high that they just move to Switzerland

Honestly, they should probably leave income alone and just double down on the wealth tax.

Wage-based taxation has always been an awkward way to target the rich.

I have very different feelings about someone from a poor background who went into massive debt to develop their skills and become a top earner vs. someone who inherited a fortune and doesn’t put any effort beyond checking their bank balance periodically.

Plus, there is the “won’t they just leave?” argument. Which is mostly FUD, but in the case where someone’s wealth is based on their skilled labor they do have a much easier time just leaving. If your wealth is from owning a portfolio of apartment buildings, good luck taking those with you.

The moving part is very real for the ultra rich in Europe.

In Norway they transfer their assets to their kids and send them to live in Switzerland for them.

Does no one here understand how incone taxes work? The 90% rate is on annual income over €400,000. Average annual income in France was €41,000.

I think the guy you're responding to is more talking about the distinction between income and capital gains, with income making up far less of the wealthy's worth than existing investments.

But yes, a lot of people also have no concept of how tax brackets work.

The end result is that basically no one will be subject to this tax bracket.

It is high enough that everyone at that level will mainly get their real income from stock/loan which aren't salaries.

Having this tax bracket or not having it is, basically the same for the super wealthy. The real method to tax them is through capital tax, not income.

This is a bit of a misleading summary.

Melenchon speaks for his own party, France Unbowed (LFI), not the entire NFP alliance.

The NFP as a whole has not declared support for Melenchon's position, although his party controls 71 (~41%) of NFP's 180 seats in the National Assembly.

Macron has already indicated that he will not allow Melenchon to become Prime Minister, and the entire NFP will be aware that they must select a more moderate leader to represent them if they expect to gain enough support from the centre to operate as a minority government.

It's not just Macron or Ensemble, even within the NFP some parties don't want Melenchon from what I understand. At least the PS (Parti Socialiste, but they're actually just social democrats) which has 59 seats and therefore the second most seats in the NFP doesn't want him to be prime minister.

Thx stranger, so hard to get news from a single source if you're not a specialist on the topic

Macron has already indicated that he will not allow Melenchon to become Prime Minister

Good news for LePen, I guess.

Sounds great, now how are they proposing to tax the wealthy. You know, those people who have a jet set lifestyle but no income to tax?

The answer would be of course they have income, and we have to adequately recognize it as such.

Borrowing money against stocks? Income. Capital gains on high value or nonessential assets (e.g. non-primary residences and stock)? Income.

Actual money has to come in at some point to manifest that lifesytyle and that is obviously income.

To be clear the 90% tax is an income tax, which is actually not unprecedented as other commenters note. Melenchon has talked about 100% but I guess the other parties negotiated him down.

Actually, 90% income tax for the top incomes was common in western countries in the 50s.

I will enjoy hearing about how the rich will just move away from their fancy mansions on the Riviera and their suites in Paris to avoid paying this tax and then seeing it not happen.

Why would they move? This is an income tax, not a wealth tax and the wealthy typically have relatively little "income". Sure they may have a net worth of tens, hundreds, or even thousands of millions but their "incomes" (as defined by tax codes) can be surprisingly low.

Look at the CEOs like Steve Jobs and Jeff Bezos whose salary was a single US dollar. They were incredibly wealthy but had nearly no normal income.

So unless you jigger the tax code to capture the work arounds the wealthy use this income tax will hardly touch them. It will only catch high wage earners, like a software dev working FAANG or something.

The real problem isn't the income the rich receive, it's their tax avoidance methods that never show up as any income. This effectively puts a barrier on anyone who isn't being a scummy shithead from ever reaching their level, it creates a safe harbor for billionaires to laugh from at anyone who ever reaches their level of influence, power, and wealth and might become their competitor if they do not do so in the manner of their oligarchic decades of experience within their inner circle.

This only convinces idiots, and is about as cluelessly meaningless populist legislation as anything fooling far right fascists. Literally ask yourself, who is the rich, because I can guarantee you it will only affect anyone from low to middle income classes who manage to find any wealth without seeking the horde of tax lobbyists true billionaires have.

Case in point, want to know what "rich" is for this piece of legislation? 90% tax on anyone who happens to earn above €400,000 (£337,954) for that year. I doubt this will even affect people earning above €400,000 every year because they have enough wealth and experience with paying the sort of tax advisors that will help orient them into tax avoidance. Billionaires are laughing at this measure.

I would not be surprised if this suggesting could be traced back to "think tanks" coming with this sort of bullshit that only caters and convinces the ignorant while shielding the actually rich. I realize most people will see this as a good thing because they see this as affecting "the rich", but it really and truly does nothing against the real problem, and I would not even mind it if it wasn't a sign that nothing will be done about billionaire and corporate tax avoidance schemes and that they are only trying to cater to a sentiment.

Have you seen the word "income"anywhere here ? ISF (Impôt sur la fortune) is tax on wealth, this law would say that if someone is rich we take some of its money. We use to have it in France before Macron removed it. Also the same leftist group is advocating for more funding towards fighting tax evasion amongst the wealthy.

EDIT: my bad the article does talk about income tax, point still stand, NFP still advocate for the ISF

Back in the 50s and 60s after WW2 the UK had a 95% tax band for the highest earners. This was due to the country struggling to pay off its debts to the USA after WW2. The Beatles even wrote their song Taxman about it in 1966.

Ultimately there is a problem with these super high taxbands whereby countries that try them will often encounter something called the Laffer Curve whereby overall tax take decreases as the tax rate increases. This isn't even necessarily tax evasion, all it takes is for wealthy people to be suitably motivated to avoid taxes.

In the UK now if your income breaches £100k then you are paying a higher rate of tax on everything earned over that amount but also you lose the £12.5k tax free allowance that all citizens are entitled to. Overall breaching £100k leads to you paying a marginal rate of tax of 60% even if you don't earn much over it. Because of this high earning jobs often let you put money into salary sacrifice pension schemes to avoid breaching the £100k mark. It only becomes worthwhile earning over £100k when you reach the region of ~£130k, which is substantially more. Essentially the system encourages tax avoidance by having this cliff which people who are behaving like rational agents will do anything to avoid. If it were less punative then some economists argue that the government would raise more money.

That's just a bad implementation, then. Tax brackets are progressive for a reason, having a cliff like that should be an obvious no no.

Not to say you don't have a point, because you do, but the govt could fix that particular issue very easily.

That's uh.... pretty fucking dumb.

How the fuck did anyone think a cliff like that would be smart.

You make it sound like a cliff, but you lose £1 of the £12.5k allowance for every £2 over £100k you earn. You don't suddenly lose the whole allowance at £100,001.

Petrol price controls is a terrible idea.

Why not subsidised (free) public transport, more cycle lanes more cycle parking, subsidised electric bikes, mandated EV charging.