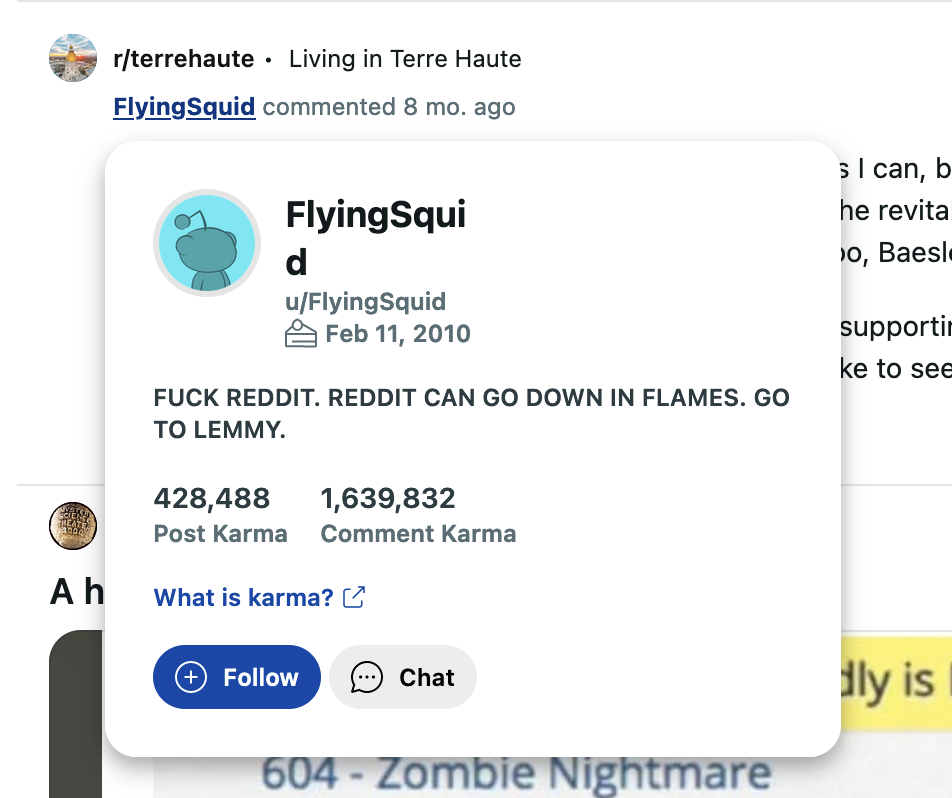

They're just trying to get people to tie their real names, addresses, email, and financial information to their profiles, especially the ones with established post histories going back years.

They can figure some of that out, but all rolled up and verified by the account holder?

That makes their data on users waaaaaay more valuable to the people who buy data.