Thanks for posting this, very juicy, let's dive in 💎 🤙

Tokenised stocks are an alternative to their traditional counterpart. In order for tokenised stocks to be a perfect substitute the price of tokenised stocks has to be perfectly correlated to the price of the traditional stock.

Okay, so tokenized stocks only function as a proxy when the prices are synced. Gotcha, this is the underlying assumption at play here.

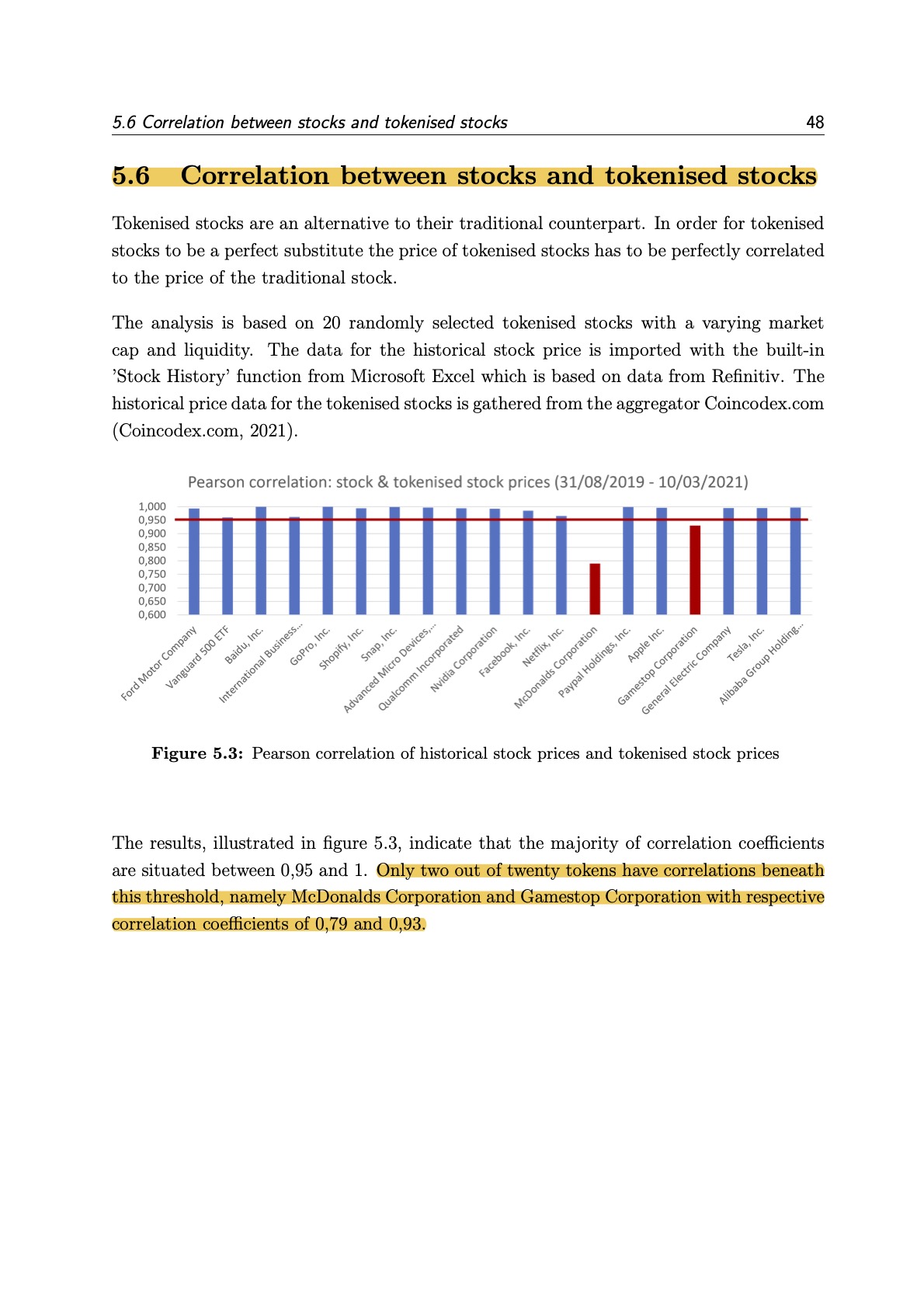

The analysis is based on 20 randomly selected tokenised stocks with a varying market cap and liquidity.

Okay so they looked at tokenized stock from a random sampling.

Only two out of twenty tokens have correlations beneath this threshold, namely McDonalds Corporation and Gamestop Corporation with respective correlation coefficients of 0,79 and 0,93.

Alright, the good stuff. Of the tokenized stocks from the random sample, two of them deviate greatly from their peers with their correlation coefficient*. Which is stat slang for saying that the underlying assumption of "perfectly correlated" is quite imperfect with 70% for McDonald's and 93% for GME.

Price discovery is quite blurry in that 7% spread, presumably to the benefit of market makers and HFT and at the expense of price discovery for actual investors. Eg you want to buy a token (for some reason), so your exchange charges you the price of the real stock then delivers you a token and pockets the difference.

The conclusion here is that the GME is a poor tokenized stock because the correlation coefficient is an abysmal 93%; the 7% variance in price discovery is fucking embarrassing for the SEC's mandate** for maintaining fair, orderly, and efficient markets.

-

*A correlation coefficient is a number between -1 and 1 that tells you the strength and direction of a relationship between variables. https://www.scribbr.com/statistics/correlation-coefficient/