this post was submitted on 05 Dec 2023

24 points (92.9% liked)

DRS Your GME

1228 readers

1 users here now

ΔΡΣ Central

Community to discuss the DRSGME.org project and resources, and how to spread DRS advocacy and information to GameStop investors around the world.

Have a great idea to spread the word? There are some resources here to get started!

https://www.drsgme.org/free-resources

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

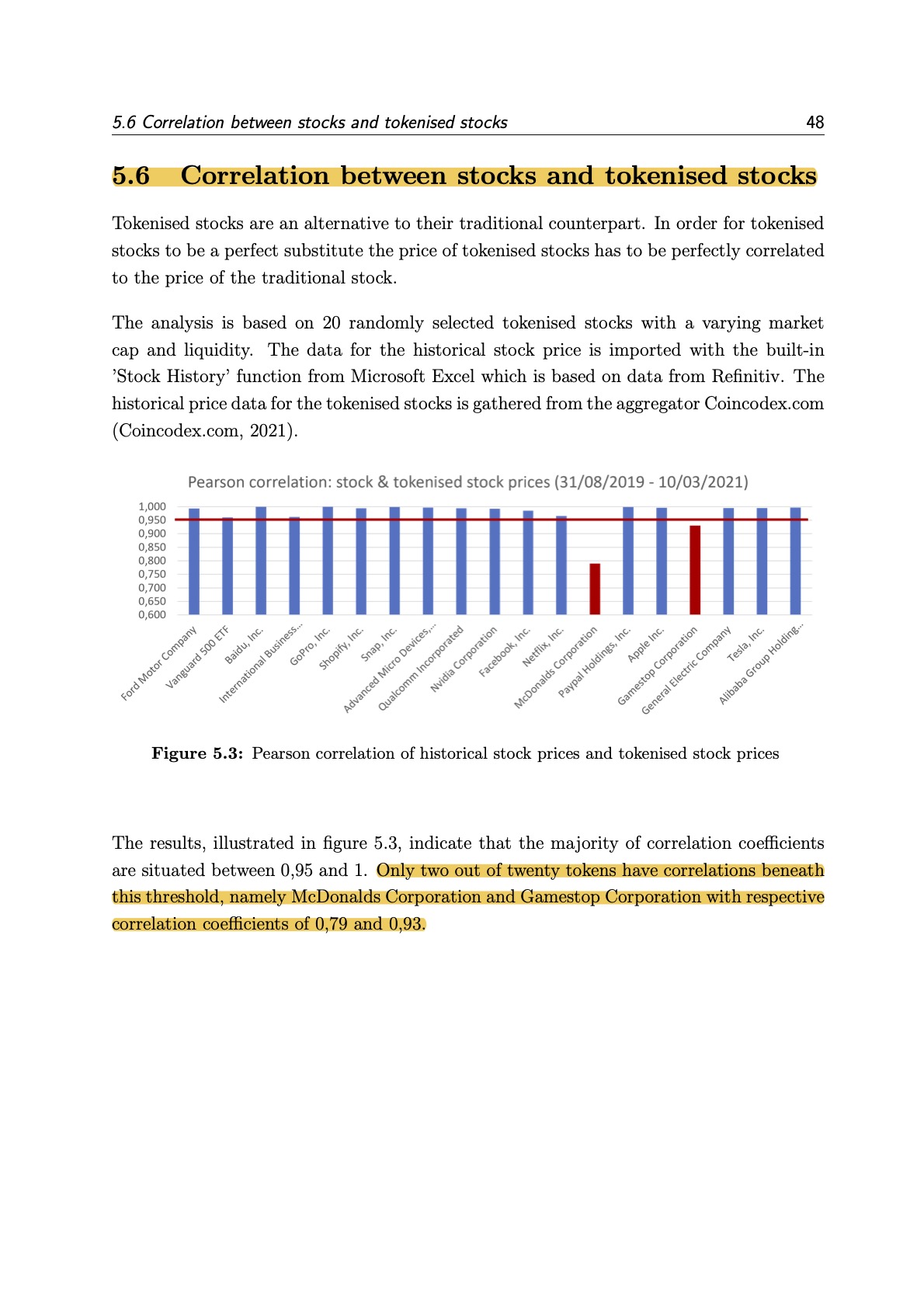

You are being rude, and this idiosyncrasy is significant. I will try to explain for you in simple terms. Although the price of a stock varies over time, at any given time, the price should be approximately the same across brokers. (And for tokenized stocks to substitute for non-tokenized stocks, then their prices also need to correspond.) When I buy a stock on Charles Schwab, then the price should be the same as when you buy the same stock on Fidelity. If you get a different price from me, higher or lower, then the price of the stock is wrong. No Bonferroni correction necessary. It doesn't matter whether this happens for every stock or just one idiosyncratic stock. If the price is different, then the price is wrong.

Tell me you dont understand how a market works without telling me you dont understand how a market works.

National best bid and offer