this post was submitted on 05 Dec 2023

24 points (92.9% liked)

DRS Your GME

1228 readers

1 users here now

ΔΡΣ Central

Community to discuss the DRSGME.org project and resources, and how to spread DRS advocacy and information to GameStop investors around the world.

Have a great idea to spread the word? There are some resources here to get started!

https://www.drsgme.org/free-resources

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Thanks for posting this, very juicy, let's dive in 💎 🤙

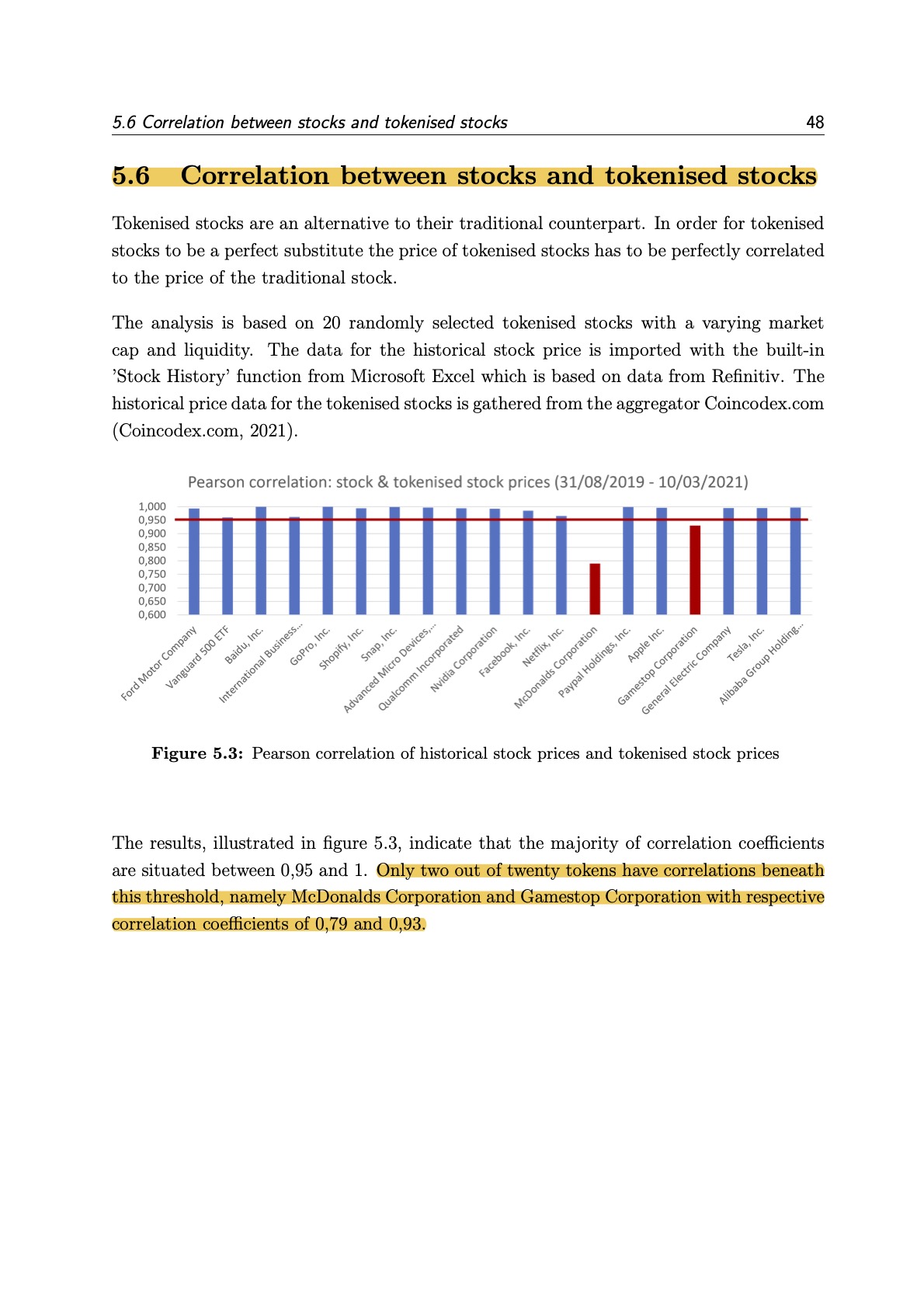

Okay, so tokenized stocks only function as a proxy when the prices are synced. Gotcha, this is the underlying assumption at play here.

Okay so they looked at tokenized stock from a random sampling.

Alright, the good stuff. Of the tokenized stocks from the random sample, two of them deviate greatly from their peers with their correlation coefficient*. Which is stat slang for saying that the underlying assumption of "perfectly correlated" is quite imperfect with 70% for McDonald's and 93% for GME.

Price discovery is quite blurry in that 7% spread, presumably to the benefit of market makers and HFT and at the expense of price discovery for actual investors. Eg you want to buy a token (for some reason), so your exchange charges you the price of the real stock then delivers you a token and pockets the difference.

The conclusion here is that the GME is a poor tokenized stock because the correlation coefficient is an abysmal 93%; the 7% variance in price discovery is fucking embarrassing for the SEC's mandate** for maintaining fair, orderly, and efficient markets.

*A correlation coefficient is a number between -1 and 1 that tells you the strength and direction of a relationship between variables. https://www.scribbr.com/statistics/correlation-coefficient/

*https://www.sec.gov/about/mission

Thank you for your analysis!