Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

view the rest of the comments

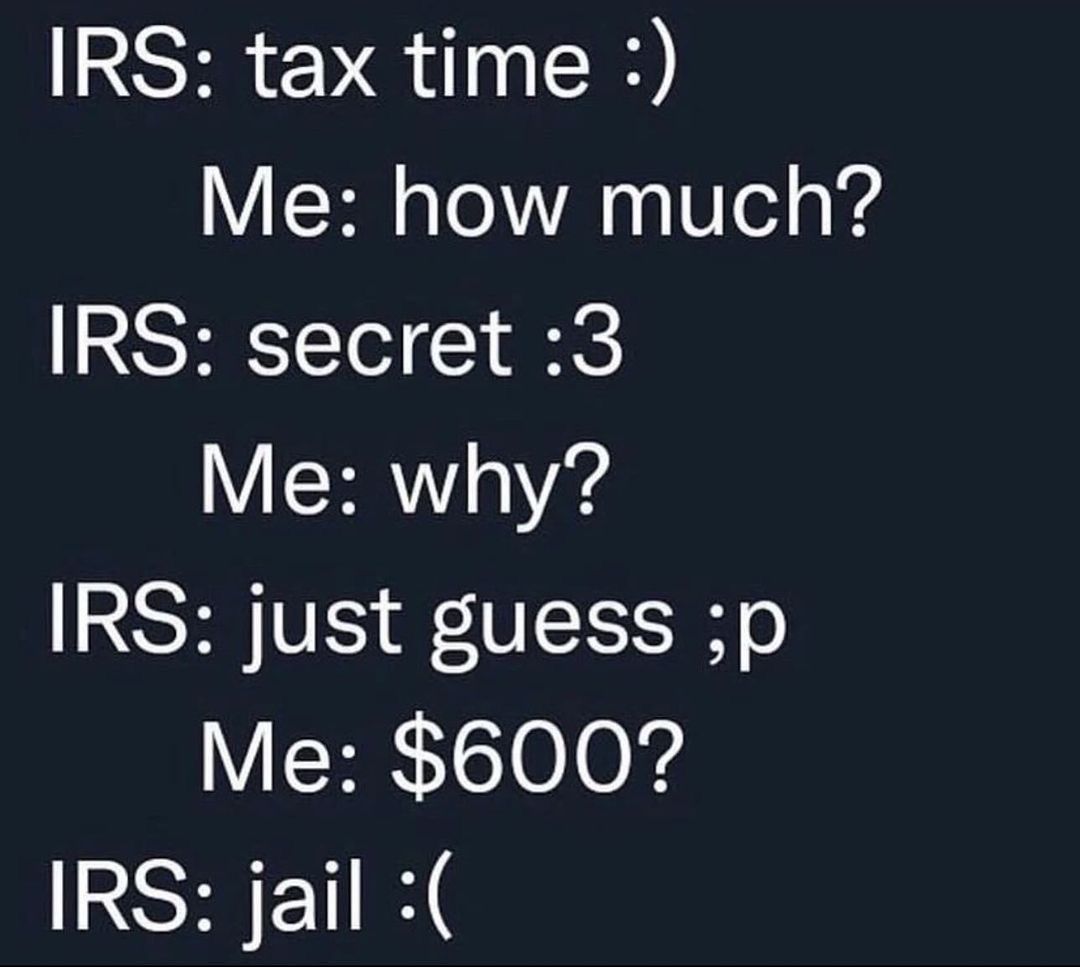

How it actually works is that the IRS doesn't known how much you need to pay. You provide your income and taxes already paid throughout the year then the IRS says "yeah, looks about right for what you made" or here's money back you paid to much or didn't pay enough. It only gets complicated when you have huge amounts of money.

That's still dumb AF, they could easily do like many other countries do and send you a breakdown of what you owe/getting back and why. You look it over and go "looks good to me" and have to do nothing or "This part is wrong" or "I qualify for Y tax break/incentive/credit" and then file some proof and you're done.

But the tax prep companies lobby really hard to keep things as difficult as they are

and there is a tax form that is setup exactly like this available for years. the 1040x. but they don't use that to predo our taxes.

Your employer is required to submit the amount you were paid and the taxes that were withheld. The IRS knows how much you owe assuming that is your one source of income and you don't have deductions beyond the standard.

Exactly. The IRS has TONS of information on every individual and business. There may be some unreported items, but that’s the exception to the rule.

The IRS has a “transcript” with all of the many reported transactions associated with each person/entity. And you can request this transcript, which many people with complicated tax situations do so they can verify that everything is reported correctly and their records match the IRS data.

https://www.irs.gov/individuals/get-transcript

Many people have deductions beyond the standard

And that should be the only shit you needed to enter yourself.

That's only true if you're getting paid cash under the table, make tips, or are self-employed. Your job reports your earnings to the IRS.

Pretty much how it works in India too.