GameStop was profitable for the first time in 6 years

GameStop reported full-year profitability for fiscal year 2023, contradicting the prevailing media sentiment that GameStop is a terrible company destined for bankruptcy

Summary

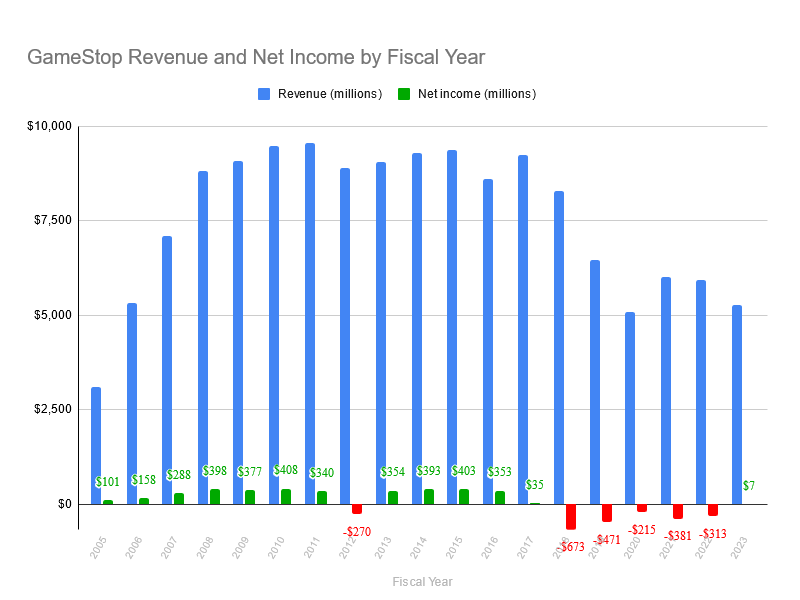

- On March 26, 2024, GameStop released financial results for the fourth quarter and fiscal year ended February 3, 2024, demonstrating small but not insignificant full-year profits for the first time in 6 years, despite reduced revenues. "Net income was $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022."

- Sentiment of GameStop found in financial media continues to be negative, dishonest, and cynical, despite the undeniable but often ignored improvements to the fundamentals of the company that have been achieved by the new management team. In most cases, the fact that GameStop was profitable for the first time in 6 years is not even mentioned at all.

Historical context

From a historical point of view, GameStop was consistently profitable every fiscal year from 2005 through 2016, with the exception of 2012. Starting in fiscal year 2017, GameStop began showing reduced profitability, and from FY 2018 through FY 2022, was unprofitable.

Source: GameStop 10-K filings - Google Sheets

Looking exclusively at revenue, it is clear that there has been a significant reduction starting approximately with fiscal year 2019. Much of this can be attributed to the fact that gamers are increasingly buying games digitally rather than in the form of physical discs such as can be purchased at a brick-and-mortar retail store like GameStop.

Yet, even in fiscal years 2017 and 2018, it is clear that despite high revenues the company was not performing well.

Heading through 2020, GameStop was undeniably a struggling company facing significant challenges, and according to many was destined for bankruptcy. The trading price of GME reflected this prevailing sentiment, and the financial media was dutifully critical.

Company turnaround

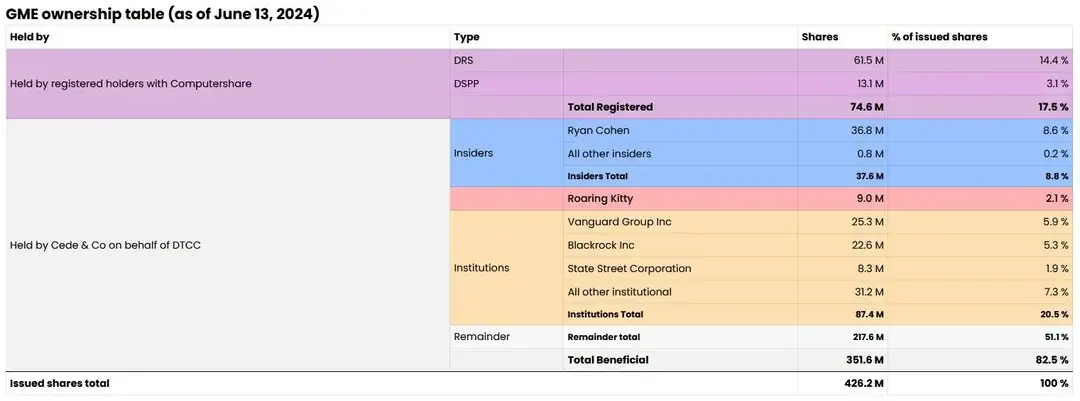

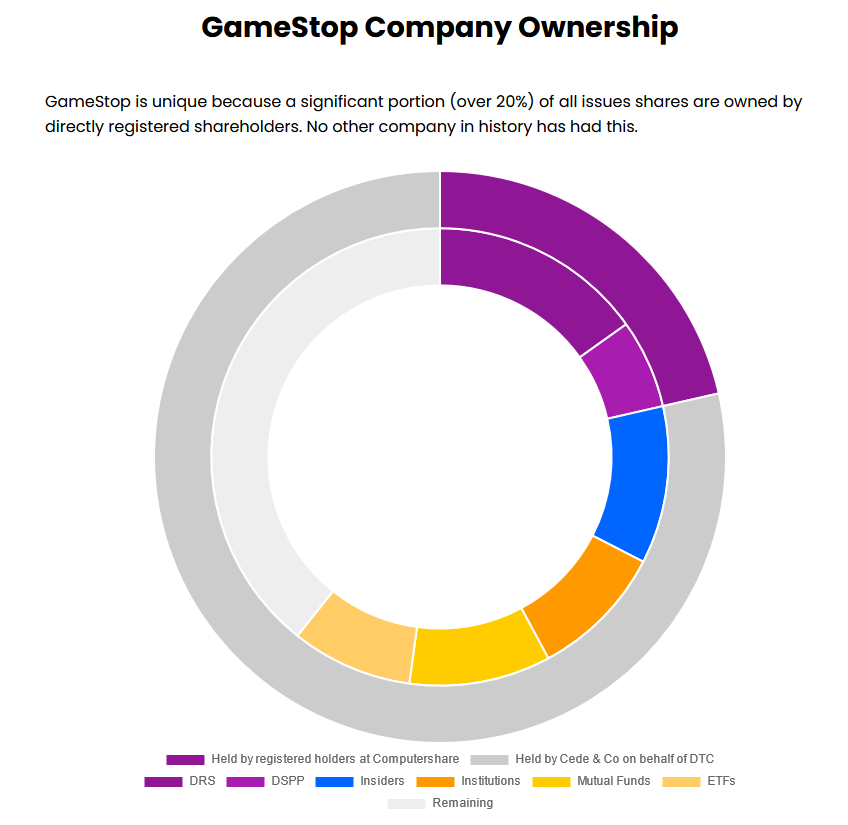

In 2020, activist investor Ryan Cohen began purchasing shares of GME, ultimately becoming the largest individual owner of the company with approximately 12% ownership. By June 2021, the entire board of directors of the company was replaced by Ryan Cohen and his associates, with Ryan Cohen becoming chairman of the board. From this time onward, control of the company was completely in the hands of this new leadership team.

"We inherited a bunch of legacy everything, and under-investment across the entire business –- people, the entire technology stack, just decades of neglect, and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under, but that was also part of the attraction going into GameStop was that a transformation the likes of GameStop was really unprecedented and I was motivated by that."

The company went from a situation where it was losing hundreds of millions of dollars per year to net profitability in fiscal year 2023.

While this is an undeniably positive result for the company in this time period, GameStop continues to face numerous challenges and must continue to improve and adapt in order to successfully compete in the modern video game industry.

Media sentiment

What does mainstream financial media have to say about GameStop achieving full-year profitability for the first time in 6 years?

-

GameStop faces 'unsustainable' sales decline, cuts jobs to control costs

- Focuses on job cuts, reduced revenue, leans on the opinion of Michael Pachter

- Fails to mention GameStop achieving full-year profitability

-

GameStop Q4 Earnings Highlights: Retail Favorite Stock Plunges After Revenue, EPS Miss

- Emphasis on GME share price going down

- Focuses on reduced revenue

- Did mention some favorable facts

- Fails to mention GameStop achieving full-year profitability

-

GameStop Stock Plummets Following Q4: Profitability Fails to Offset Significant Revenue Miss

- Headline emphasizes GME share price is down

- Makes clear that GameStop achieved full-year profitability for the first time in years

- Generally fair reporting of other facts

-

GameStop Stock Plunges After Earnings Fall Short of Expectations—Key Level to Watch

- Headline emphasizes GME share price is down, 'expectations' were missed

- Focus on job cuts, reduced revenue

- Fails to mention GameStop achieving full-year profitability

-

Jim Cramer Says GameStop Is Arguably The Worst Company In America

- Article is entirely negative, leans on the opinions of Jim Cramer and Michael Pachter

- Fails to mention GameStop achieving full-year profitability

-

GameStop Q4 Earnings Smash Wall Street Expectations: Reports Profitability For First Time In Over Half A Decade

- Makes clear and emphasizes contextual significance of GameStop's full-year profitability

- Generally positive about GameStop's financial circumstances

-

GameStop could be gone in less than 5 years, says analyst

- Article is almost entirely negative, leans on the opinions of Michael Pachter

- Does mention GameStop's positive cash holdings of $1.2 billion

- Claims that Reddit's WallStreetBets has 'seemingly walked away from the “stonk”', fails to mention that GME discussion is censored on WallStreetBets (formally banned by the moderators in 2022), fails to mention that GME shareholders are found in different online communities

- Fails to mention GameStop achieving full-year profitability

-

GameStop Needs To Get Its Game Back

- Focuses on reduced revenue, job cuts

- Weak mention of GameStop posting a full-year profit of $6.7 million

- Generally fair assessment of the struggles faced by GameStop

-

GameStop Confirms More Layoffs, Share Price Tumbles After Sales Slide

- Headline emphasizes job cuts, GME share price is down

- Generally neutral article

- Does mention GameStop's full-year profitability

-

A Sales Slump Is the Kiss of Death for GameStop Stock

- Entirely negative article, leans on the opinion of Michael Pachter

- Fails to mention GameStop achieving full-year profitability

- 'If you value your wealth, just stay away from GameStop stock.'

-

GameStop saga ends. Winner: capital markets

- Entirely negative article, leans on the opinion of Michael Pachter

- Focuses on GME share price being down

- Fails to mention GameStop achieving full-year profitability

- 'In this case, “shorts” were right... The meme army may have lost, but perhaps next time will be clearer-eyed.'

-

GameStop Stock: Is This The End of a Saga Or Just Another Chapter?

- Despite any sentiment implied by the headline, this article provides a mostly neutral assessment of GameStop's circumstances

- Mentions GameStop achieving full-year profitability

Searching for recent news about GameStop yields mostly negative sentiment that fails to even mention at all that GameStop achieved full-year profitability for the first time in 6 years.

Failing to mention this important detail is a deliberate decision that reveals a clear bias in the media. It goes beyond just reporting about true negative facts about GameStop. It demonstrates a deliberate effort, by those culpable writers and media outlets, to propagate a specific sentiment about the company that is not allowed to even mention contextually important true positive facts about the company.

GameStop was profitable for the first time in 6 years - this is the news headline that captures the significance of GameStop's recent earnings report. Yet, an unassuming person who consumes mainstream financial media likely would not even learn about this important fact at all.

Who would benefit from that?

Ongoing financial conflict

Why are there competing, mutually exclusive narratives?

There are competing narratives because there are competing financial interests.

One of the listed news articles, GameStop saga ends. Winner: capital markets, from Reuters, draws some attention to this ongoing conflict while declaring that the conflict is actually over and one side has won and one side has lost.

GME shareholders that believe in the company turnaround and leadership, despite the real challenges faced by GameStop, have a vested financial interest in the success of the company, with a desire for the share price of GME to go up, and naturally will promote the narrative that supports this financial interest.

In opposition to GME shareholders are all of the financial market participants that have a vested financial interest in the share price of GME going down. An example of such a participant would be any hedge fund that has a net short position on GME. The article refers to this faction as "shorts", recogonizing that such a faction with an interest does exist. Naturally, members of this faction will promote the narrative that supports their financial interest.

If the prospect of GameStop's success was not an ongoing threat to one faction of incumbent market participants, then there would be no reason to deliberately omit the fact of GameStop's profitability, to pretend that it isn't something that even happened at all.

Recognizing that there is an ongoing financial competition between factions that stand to benefit financially from a particular outcome of the GME share price, which faction benefits when most mainstream financial media articles propagate negative sentiment about GameStop and deliberately ignore the contextually significant fact that GameStop was profitable?

It is clear: much of mainstream financial media is actively propagating biased narratives to the benefit of the faction that has a vested financial interest in the share price of GME going down.

An interactive version of this article can be found at gmetimeline.org/fy23-profitability

🤷

🫡