GME Timeline

A place for discussing the chronicles of the GME saga, supplementary to the website

gmetimeline.org

Please use this community to discuss or post any historical events that bear any significance or relationship to the GME story.

Please also use this community to discuss any of content on the gmetimeline.org website.

If the website is missing any events or information that you think it should have, please post it here to have it added.

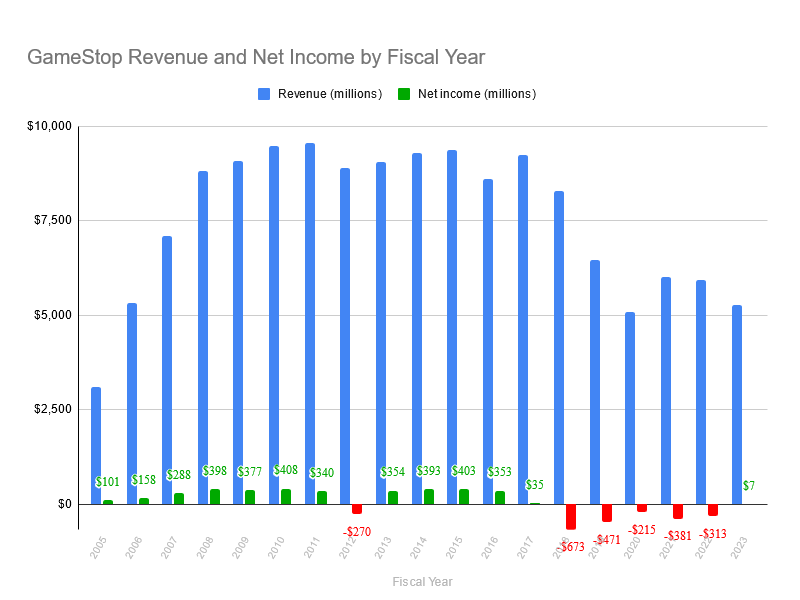

GameStop was profitable for the first time in 6 years

GameStop reported full-year profitability for fiscal year 2023, contradicting the prevailing media sentiment that GameStop is a terrible company destined for bankruptcy

Summary

- On March 26, 2024, GameStop released financial results for the fourth quarter and fiscal year ended February 3, 2024, demonstrating small but not insignificant full-year profits for the first time in 6 years, despite reduced revenues. "Net income was $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022."

- Sentiment of GameStop found in financial media continues to be negative, dishonest, and cynical, despite the undeniable but often ignored improvements to the fundamentals of the company that have been achieved by the new management team. In most cases, the fact that GameStop was profitable for the first time in 6 years is not even mentioned at all.

Historical context

From a historical point of view, GameStop was consistently profitable every fiscal year from 2005 through 2016, with the exception of 2012. Starting in fiscal year 2017, GameStop began showing reduced profitability, and from FY 2018 through FY 2022, was unprofitable.

Source: GameStop 10-K filings - Google Sheets

Looking exclusively at revenue, it is clear that there has been a significant reduction starting approximately with fiscal year 2019. Much of this can be attributed to the fact that gamers are increasingly buying games digitally rather than in the form of physical discs such as can be purchased at a brick-and-mortar retail store like GameStop.

Yet, even in fiscal years 2017 and 2018, it is clear that despite high revenues the company was not performing well.

Heading through 2020, GameStop was undeniably a struggling company facing significant challenges, and according to many was destined for bankruptcy. The trading price of GME reflected this prevailing sentiment, and the financial media was dutifully critical.

Company turnaround

In 2020, activist investor Ryan Cohen began purchasing shares of GME, ultimately becoming the largest individual owner of the company with approximately 12% ownership. By June 2021, the entire board of directors of the company was replaced by Ryan Cohen and his associates, with Ryan Cohen becoming chairman of the board. From this time onward, control of the company was completely in the hands of this new leadership team.

"We inherited a bunch of legacy everything, and under-investment across the entire business –- people, the entire technology stack, just decades of neglect, and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under, but that was also part of the attraction going into GameStop was that a transformation the likes of GameStop was really unprecedented and I was motivated by that."

The company went from a situation where it was losing hundreds of millions of dollars per year to net profitability in fiscal year 2023.

While this is an undeniably positive result for the company in this time period, GameStop continues to face numerous challenges and must continue to improve and adapt in order to successfully compete in the modern video game industry.

Media sentiment

What does mainstream financial media have to say about GameStop achieving full-year profitability for the first time in 6 years?

-

GameStop faces 'unsustainable' sales decline, cuts jobs to control costs

- Focuses on job cuts, reduced revenue, leans on the opinion of Michael Pachter

- Fails to mention GameStop achieving full-year profitability

-

GameStop Q4 Earnings Highlights: Retail Favorite Stock Plunges After Revenue, EPS Miss

- Emphasis on GME share price going down

- Focuses on reduced revenue

- Did mention some favorable facts

- Fails to mention GameStop achieving full-year profitability

-

GameStop Stock Plummets Following Q4: Profitability Fails to Offset Significant Revenue Miss

- Headline emphasizes GME share price is down

- Makes clear that GameStop achieved full-year profitability for the first time in years

- Generally fair reporting of other facts

-

GameStop Stock Plunges After Earnings Fall Short of Expectations—Key Level to Watch

- Headline emphasizes GME share price is down, 'expectations' were missed

- Focus on job cuts, reduced revenue

- Fails to mention GameStop achieving full-year profitability

-

Jim Cramer Says GameStop Is Arguably The Worst Company In America

- Article is entirely negative, leans on the opinions of Jim Cramer and Michael Pachter

- Fails to mention GameStop achieving full-year profitability

-

- Makes clear and emphasizes contextual significance of GameStop's full-year profitability

- Generally positive about GameStop's financial circumstances

-

GameStop could be gone in less than 5 years, says analyst

- Article is almost entirely negative, leans on the opinions of Michael Pachter

- Does mention GameStop's positive cash holdings of $1.2 billion

- Claims that Reddit's WallStreetBets has 'seemingly walked away from the “stonk”', fails to mention that GME discussion is censored on WallStreetBets (formally banned by the moderators in 2022), fails to mention that GME shareholders are found in different online communities

- Fails to mention GameStop achieving full-year profitability

-

GameStop Needs To Get Its Game Back

- Focuses on reduced revenue, job cuts

- Weak mention of GameStop posting a full-year profit of $6.7 million

- Generally fair assessment of the struggles faced by GameStop

-

GameStop Confirms More Layoffs, Share Price Tumbles After Sales Slide

- Headline emphasizes job cuts, GME share price is down

- Generally neutral article

- Does mention GameStop's full-year profitability

-

A Sales Slump Is the Kiss of Death for GameStop Stock

- Entirely negative article, leans on the opinion of Michael Pachter

- Fails to mention GameStop achieving full-year profitability

- 'If you value your wealth, just stay away from GameStop stock.'

-

GameStop saga ends. Winner: capital markets

- Entirely negative article, leans on the opinion of Michael Pachter

- Focuses on GME share price being down

- Fails to mention GameStop achieving full-year profitability

- 'In this case, “shorts” were right... The meme army may have lost, but perhaps next time will be clearer-eyed.'

-

GameStop Stock: Is This The End of a Saga Or Just Another Chapter?

- Despite any sentiment implied by the headline, this article provides a mostly neutral assessment of GameStop's circumstances

- Mentions GameStop achieving full-year profitability

Searching for recent news about GameStop yields mostly negative sentiment that fails to even mention at all that GameStop achieved full-year profitability for the first time in 6 years.

Failing to mention this important detail is a deliberate decision that reveals a clear bias in the media. It goes beyond just reporting about true negative facts about GameStop. It demonstrates a deliberate effort, by those culpable writers and media outlets, to propagate a specific sentiment about the company that is not allowed to even mention contextually important true positive facts about the company.

GameStop was profitable for the first time in 6 years - this is the news headline that captures the significance of GameStop's recent earnings report. Yet, an unassuming person who consumes mainstream financial media likely would not even learn about this important fact at all.

Who would benefit from that?

Ongoing financial conflict

Why are there competing, mutually exclusive narratives?

There are competing narratives because there are competing financial interests.

One of the listed news articles, GameStop saga ends. Winner: capital markets, from Reuters, draws some attention to this ongoing conflict while declaring that the conflict is actually over and one side has won and one side has lost.

GME shareholders that believe in the company turnaround and leadership, despite the real challenges faced by GameStop, have a vested financial interest in the success of the company, with a desire for the share price of GME to go up, and naturally will promote the narrative that supports this financial interest.

In opposition to GME shareholders are all of the financial market participants that have a vested financial interest in the share price of GME going down. An example of such a participant would be any hedge fund that has a net short position on GME. The article refers to this faction as "shorts", recogonizing that such a faction with an interest does exist. Naturally, members of this faction will promote the narrative that supports their financial interest.

If the prospect of GameStop's success was not an ongoing threat to one faction of incumbent market participants, then there would be no reason to deliberately omit the fact of GameStop's profitability, to pretend that it isn't something that even happened at all.

Recognizing that there is an ongoing financial competition between factions that stand to benefit financially from a particular outcome of the GME share price, which faction benefits when most mainstream financial media articles propagate negative sentiment about GameStop and deliberately ignore the contextually significant fact that GameStop was profitable?

It is clear: much of mainstream financial media is actively propagating biased narratives to the benefit of the faction that has a vested financial interest in the share price of GME going down.

An interactive version of this article can be found at gmetimeline.org/fy23-profitability

January 6, 2022: GameStop Plans to Launch an NFT Marketplace

February 3, 2022:

GameStop Forms Partnership with Immutable X

The partnership establishes an up to $100 million fund in Immutable X’s IMX tokens, which the parties intend to use for grants to creators of non-fungible token (“NFT”) content and technology. Immutable X will also become a layer-2 partner and platform for GameStop and the Company’s NFT marketplace that is expected to launch later this year.

March 23, 2022:

-

GameStop NFT Marketplace, powered by Loopring L2

- Loopring Announces GameStop NFT Beta Launch, Built on LRC L2, Live Now

May 23, 2022:

-

GameStop Launches Wallet for Cryptocurrencies and NFTs

- GameStop Launches Wallet for Cryptocurrencies and NFTs

July 11, 2022:

GameStop Launches NFT Marketplace

GameStop announced that it has launched its non-fungible token (“NFT”) marketplace to allow gamers, creators, collectors and other community members to buy, sell and trade NFTs.

August 30, 2022: GameStop releases first set of GMERICA NFTs.

September 7, 2022:

GameStop Forms Partnership with FTX

November 11, 2022:

GameStop ends partnership with FTX after FTX collapse.

March 29, 2023: GameStop creates second set of GMERICA NFTs.

June 1, 2023: Telos Announces Strategic Collaboration with GameStop to Expand Web3 Gaming

-

June 21, 2023: Have you heard the news? GameStop Playr will be powered by @elixir_launcher!

-

June 26, 2023: GameStop Playr – Elixir and GameStop Partner to Create a New Web3 Gaming Era

-

July 22, 2023:

Elixir Games to Power GameStop Playr Platform

August 2, 2023:

GameStop (GME) Wallet shutting down as company cites 'regulatory uncertainty of the crypto space'

November 1, 2023:

Wallet support ended.

January 12, 2024:

FYI: GameStop NFT Marketplace winding down on February 2nd, 2024.

January 13, 2024

- GameStop axes its short-lived NFT marketplace as it retreats from crypto

- GameStop is pulling out of the NFT game.

February 2, 2024:

GameStop NFT Marketplace to shut down.

https://youtu.be/9GCGn_STx-o?t=7932 The following is a transcript lightly edited for improved readability.

Bill Pulte:

Larry, maybe you could just say hi to everyone, and then, you know, you were the first money in Chewy, which I think is now, what, a 12 or 20 billion dollar company?

Maybe you could just walk us through how you worked with Ryan Cohen, what you saw in him that did it, and then we'll get in to your multi billion dollar fund after that.

Larry Cheng:

Sure, yea, I was the first investor to meet with Ryan in person, I think that was back in 2012, I ultimately invested in the company on behalf of Volition in 2013. We invested 15 million dollars in Chewy series A as the first institutional investor in the company.

Pulte:

Let's go! Can I ask how much that 15 million turned in to? Is that public, or no?

Larry Cheng:

It's not, but, hundreds of millions I would say.

Pulte:

Everybody is cheering for you.

Larry Cheng:

Alright! I remember the first meeting with Ryan, and my first impression of him was, he said he would spend every night reading the reviews on the site, of Chewy, and if there were any issues with anyone who was unhappy, he would personally go take the lead and try to and figure out to resolve issues, and right then and there I knew he was, as customer centric, as focused on customer delight, as anyone from a first impression perspective, but that only grew over the years that I've gotten to know him. So yea, we invested in the company, it was a huge success obviously, and Ryan is a generational entrepreneur.

Pulte:

And, how old are you Larry, cause I didn't look it up but you look young as hell.

Larry Cheng:

48

Pulte:

48, wow, you look good at 48. So, 48, and you got, how big is your fund now, a couple billion?

Larry Cheng:

About a couple billion in assets under management, just shy of that, yea.

Pulte:

And, what are you investing in, and, you've got a lot of fans here, I don't know, 20, 30 thousand followers on Twitter, something like that?

Larry Cheng:

Yea, we invest, Volition is a growth equity firm, so we invest in emerging growth tech companies, so these are companies with 5, 15 million in revenue, in that zone, growing 50 to 100 percent plus. So, really dynamic emerging tech companies. We have two sides of the house, software and services is one, and internet and consumer is the other. I lead the internet and consumer team, so that's all things e-commerce, digital media, ad tech, transactional services, consumer, retail, all that good stuff, all fun stuff.

Pulte:

Love it. Okay, so, is there anything you want to tell this crowd?

Larry Cheng:

I think this is truly inspirational that you guys are all together. You guys are really defining what it means for retail investors to be in community, and what comes from that. And so, you know, when I think about what, where this is headed and where communities are going, from impacting the financial markets, it's wherever you guys in this room want to go. Because you guys are on the forefront, and you're leading it, and so kudos to you guys, because, I think that the power of individual investors in community will only grow over time. And, there are days in the future, where rooms like what you have, will be more important and more influential than Goldman Sachs.

Pulte:

Wow. Did you hear that? Wow. That's amazing.

Larry, really appreciate the sentiment. And Larry, we've got, I'll have to send it to you later, but we've got an airport hanger full of people, this room cost way too much to rent, the stereos cost way too much, I'm gonna end up having to write probably a 40 thousand dollar check, which I'm happy to write, you know, 40 thousand dollars for this party, it's basically a party right, is this not a party?

But, anyway, we got basically, you know, we raised money for this. People donated 500 dollars. That's a lot of money. 500 dollars is a lot of money. People donated 500 dollars to come here to be in this room.

We have 250 people, everybody paid to be here, and I really appreciate you saying that this is the future of investing, because, Larry, you know, I invest for a living, these folks now invest for a living.

I also believe that this is the future too, of investing, and I believe that, you know, having somebody who is director of a 5 billion dollar company like you are, managing 2 billion dollars, thinking this is going to be, in your words, more powerful than Goldman Sachs? Did you guys hear what he just said?

He just said that groups like this are the future and are going to be more powerful than Goldman Sachs.

I mean, that's, I have the utmost respect for them, as I'm sure he does, but that is a huge statement.

So Larry, let's just finish up here, and I know, we're going to behave ourselves, because we know you're a sitting director of a public company.

So, we want to respect that.

But, can you maybe tell us your favorite thing, you work with Ryan Cohen very directly. You were his money in Chewy.

What's your favorite thing about Ryan Cohen? Let's start there.

Larry Cheng:

Ryan is as contrarian as they come. So he's an independent thinker. He is not afraid to buck the trend, as you all know. And, he is such an original contrarian thinker. So it's inspiring to be around that. So, he's one of a kind in that respect. So that's probably my favorite thing.

Pulte:

Love it. And, again, I'm keeping it very generic, but you feel free to tell me what or what not you'll answer, these are like softball questions.

I think everybody in this room loves what I'm about to ask, which is, what is he like, inter-personally working with him?

So, everybody has all these different conspiracies, they have all these different things, people are trying to do stories on him -- you're actually somebody who is credible who works with him day to day, week to week, month to month.

What is he like when you're dealing with him inter-personally, what is he like to work with?

Larry Cheng:

It's kind of funny, when some of the articles would come out with pictures of him in kind of this foreboding, suit in a dark room, I would text him and say, that picture looks ridiculous.

And I would say, Ryan is actually quite humble and open handed as a person, and so, he listens, but he's very directed in what he wants to do.

Pulte:

Is he funny? Is he funny?

Larry Cheng:

He's a funny guy. He's actually rather understated. He's funny but understated. Very humble. And, don't imagine a foreboding, huge, ominous figure. That's not Ryan Cohen. He's very customer-centric, and just a very independent thinker, as I mentioned before.

That's how I would describe him.

Pulte:

Love it. What other questions about Ryan Cohen do we have? We have to keep it very generic.

Kais:

Did you have the chance to meet Ted Cohen?

Larry Cheng:

I did not.

Kais:

I'm sure you heard Ryan talking about his father. Can you tell us, some things you heard from him about his father?

Larry Cheng:

I think it's best for Ryan to talk about his father. All I will say is that, his father is an inspiration to him.

Pulte:

Very good. Thank you Larry.

Have you heard of the PP show before tonight, or no Larry?

Larry Cheng:

I have.

PP:

Oh really? What do you think about the PP show, Larry?

Larry Cheng:

Honestly, I didn't know much, but, I think I saw, Bill you went on it once.

Pulte:

Yes I did. Yes I did.

Larry Cheng:

That's where it came across my radar.

PP:

I just have a question pertaining to Ryan Cohen. Based off, you know, you know Ryan Cohen's humor, and things like that. In your opinion, and again, you can't speak on behalf of Ryan Cohen,

Do you think he likes the PP show, where we slap people with dildos, things like that?

Larry Cheng:

I've never specifically asked him about that, so I can't answer.

Pulte:

Well thank you for being such a good sport. We really appreciate you Larry. Thank you for coming.

You have a special announcement that you want to make for everybody here, you have kind of a surprise gift.

Larry Cheng:

Yes, thank you. Actually, Bill, you were kind of my inspiration for this, not gonna lie. I saw, you were doing a lot of great things for the community, and so some of you who follow me will know that we've done some giveaways, during the holiday season with some of my companies. We are doing one today, with Grove Collaborative, which is a sustainable household essentials retail store, e-commerce store.

What I thought I'd do, since I was coming on today, is I would like to give all of the attendees of today's event a 100 dollar gift card to Grove.

Hopefully you can go and have some holiday fun there. We'll find a way to get your email so that we can email you those gift cards, but just my way of saying happy holidays to the whole community.

Pulte:

Very good. Everybody is clapping for you in the room, so thank you very much. If you guys didn't hear in the back of the room, Larry is gonna give everybody a hundred dollars, which is amazing, that's like, you know, 25 grand. So, you know, if you paid 500 tonight, you're getting at least 100 back. And, Kais is going to give for people he wants to give the people another hundred.

Kais:

Everybody.

Pulte:

Everybody, wow. And that's worth a hundred dollars right there.

So, Larry, I can't thank you enough for coming on. Hopefully -- I think we kept it like ultra PG. I don't even know if you can keep it more PG than that. But we appreciate it, we hope to have you on again. And, we'd love to do it in person some time. But, thanks again for everything, and being here.

Everybody's chanting Larry.

Larry Cheng:

Thanks so much, good to see you guys.

- Watch your expenses

- Delight your customers

- Be the person others want to follow

- Take the long view

- Trust yourself

On November 21, 2023, children's book author Ryan Cohen publishes 5 additional books in the series of 5 Teddy books which he had published in November 2022.

The newly published 5 books:

On November 19, 2022, the Wall Street Journal publishes an article titled: “GameStop’s Ryan Cohen Wants to Be More Than a Meme-Stock King” .

Not too long after, RC tweets: "I also want to be the Book King 👑", with a link to teddy.com, a website that appears to exist as a store for the single purpose of selling 5 books written by Ryan Cohen.

The 5 books:

- Teddy and the PIGGY BANKS

- Teddy goes to WORK

- Teddy and the PEOPLE WHO MAKE THE WORLD GO ROUND

- Teddy says WORDS CAN NEVER HURT YOU

- Teddy goes to CHINA

There is also an alternative interpretation to the statement "I also want to be the Book King 👑" discussed in this post

Breaking down "the GameStop story" into chapters. This is a general overview for reference purposes and is not a definitive guide.

Please feel free to provide any feedback, fact checking, or criticism of what is presented here.

Prior to 2019 - the original GameStop of the before times

The GameStop company as most people knew it and continue to perceive it, that retail store in the mall where you could go to trade in your old games for a pittance.

Who would ever believe that a company such as this would ever have any major significance?

2019 through 2020: the pre-sneeze

In 2019, Michael Burry takes a GME position, writes some letters to the company's board of directors suggesting changes. Burry eventually exits his GME position at a not-insignificant gain by December 2020.

RoaringKitty aka DeepFuckingValue also sees an opportunity in GME and takes a position and begins promoting it on YouTube and Reddit (specifically wallstreetbets). DFV's bold position is appreciated by many, and he eventually leads a large and enthusiastic online following.

Ryan Cohen buys ~ 9% stake in the company, eventually increasing that position to around ~ 13%.

By the end of 2020, there is accelerating momentum on the stock that precipitates the sneeze.

January 2021 through March 2021: the sneeze, and immediate aftermath

Ryan Cohen receives 3 seats on the board of directors.

Due to unrelenting social media excitement and purchasing by small time investors, the price of GME continually accelerates, eventually becoming a practically straight vertical upward line.

This is it. Retail investors won. They bought, they held, they kept buying, there's nothing that will stop this movement. The short hedge funds have lost. Game over.

Except it wasn't. Do you really think that power holding incumbents wouldn't abuse their unfair power advantage to screw over small time retail investors that were winning? Multiple brokers and clearing firms colluded to prevent retail from buying any more shares of GME for a period of several days, enough time for the momentum to be killed and for those incumbents to catch up and reposition themselves.

The outcome of this dramatic act was that the price of GME lost its momentum and fell dramatically, something that was beneficial to any incumbent that was holding a GME short position or otherwise had liabilities related to the situation.

Very importantly, GME shorts never closed their short positions, despite any paid promotions or other misinformation stating otherwise.

Congress holds a hearing and summons DFV to answer for his role in this situation. DFV handles it like a pro and proceeds to double down on GME.

The price of GME, after having fallen dramatically from the peak, begins rising once again.

March 2021 through June 2021 - reverberations from the sneeze and an opportunity for GameStop to raise money

Despite that the sneeze was over and the intense momentum which caused it had dissipated to some degree, the trading price of GME remained highly elevated throughout most of 2021.

GME investors migrate away from wallstreetbets and into superstonk and other subreddits.

In April, GameStop takes advantage of the high share price and completes the first of 2 large at-the-market offerings (ATMs), raising roughly half a billion dollars for the company.

In June, the board of directors becomes fully replaced with Ryan Cohen and his allies. Ryan Cohen becomes chairman of the board of directors. RC is now the largest individual shareholder of the company and as chairman has full authority of the company's leadership.

Later in June, GameStop completes the second of the 2 large ATMs, raising an additional ~ billion dollars in cash, totaling approximately $1.7 billion from both ATMs.

The company was now flush with cash and had an entirely new leadership team and a new direction. A strong position to be in to begin the execution of a turn around of an old company with decades of mismanagement and neglect.

July 2021 through December 2021 - DRS discovered and initiated

The company was working on a turnaround. However, Rome was not built in a day. The turnaround of GameStop was not something that would happen overnight.

A large number of individual investors remained bullish on the company. But the act of simply buying shares of GME and holding them was no longer producing any obvious desired effect in the market, the way that it did back before the sneeze. The market was now back in control of the price.

What more could motivated individual investors do?

Back in April, superstonk had an interview with Dr. Susanne Trimbath, author of the book Naked Short and Greedy. This interview introduced to the hive mind the idea of DRS for the first time. The idea of DRS percolated for several months, and by September, investors started posting their paper letters from Computershare, and eventually their purple circles, showing that they had directly registered their shares.

Perhaps because other ideas were exhausted and that DRS was a novel action that remained open for motivated investors, or perhaps for some other reason entirely, DRS was soon at the front of the hive mind's conscious attention.

In December, GameStop posted 2021 Q3 earnings report which stated: "As of October 30, 2021, 5.2 million shares of our Class A common stock were directly registered with our transfer agent, ComputerShare."

This was the first time any such quarterly report made mention of directly registered shares, and was received by the investor community as undeniable evidence from the company itself that DRS was an important endeavor, putting to rest a large degree of doubt which persisted around the idea.

December 2021 through end of 2022 - DRS to 25%

The consensus of the investor hive mind, despite some lingering doubt and resistance, was that DRS was the way.

For the next year, quarterly reports showed a persistent increase in the number of shares DRS'd, which was very bullish for investors that believed in it. But then, as of Q3 2022, published December 7th 2022, the number of shares that were DRS'd generally flat-lined at approximately 25% of all shares, and has remained near that level since.

Beginning of 2023 to present - loss of momentum, community divisions, an apparent stalemate

The fact that even 25% of all officially issued shares of GME have been directly registered is no small feat. At a trading price of around $25 per share near the end of 2022, this amounted to nearly 2 billion dollars worth of shares that were directly registered by a group of roughly 200,000 individual investors, the vast majority of which were people of modest means, not wealthy individuals, competing in an arena dominated by the ultra wealthy.

But, 25% falls short of what might have been expected by this point. The DRS train appears to have run out of steam.

A variety of reasons have been speculated to be the cause of this flat-lining of the DRS rate. These speculative discussions came with controversy and precipitated community division (and who might benefit from controversy and division within the GME investor community?)

For whatever the true reason, by the authority vested in the mods of superstonk, the largest subreddit and community of GME investors, these types of conversation were suddenly no longer welcome to be had there.

As a consequence of this crackdown on discussing details about DRS, the community of investors was fractured. Investors started to migrate to new community locations because certain important conversations were no longer able to be had in superstonk. Superstonk itself has since lost a large degree of enthusiasm and community spirit (who benefits?)

Despite anything and everything that has happened up to this point, the trading price of GME continues to trend downwards to fresh all-time-lows from the peak of the sneeze.

Critics of GME investors and GameStop look at the downward trend of the share price since the sneeze as indisputable proof of a trajectory that inevitably ends at zero. After all, how could an investment that apparently only trends downward be considered a good investment?

Present time, late 2023 - competing narratives (psychological warfare); pre-moass

Despite whatever has happened up to this point, good or bad, the situation persists.

The existence of a large amount of sustained cynicism and opposition towards GameStop and GME investors in the media and on social media demonstrates that some faction out there continues to have a big problem with the idea that GameStop might ever be successful. GME as an investment continues to be contrarian and controversial, because incumbents with a vested interest in GameStop's demise ~~want it~~ need it to be perceived by the masses as contrarian and controversial and dubious, for the sake of their own survival.

Moass is an idea that takes many forms and has many implications. Most people who continue to believe in that idea and all of its implicit absurdities to this day (this author included) initially expected it to be an event that should have already happened by now, but it has not.

Yet, the conditions for such an event remain.

Some hedge funds opened large GME short positions that were never closed, persisting as an existential liability.

GameStop is in the strongest financial position that it has been in since whatever glory it might have had in the before times, and continues to explore new avenues to grow revenue.

The current leadership of the company regularly demonstrates their commitment to the long term success of the company.

We find ourselves in this zero-sum game where competing factions stand to gain everything from, or lose everything to their opponents, who are on opposite sides of GameStop's potential success or failure.

Victory for one side necessarily requires the capitulation of the other side, and neither side shows any inclination of backing down.

On September 7, 2022, GameStop published Q2 2022 results and also an announcement of: GameStop Forms Partnership with FTX

The partnership is intended to introduce more GameStop customers to FTX’s community and its marketplaces for digital assets. In addition to collaborating with FTX on new ecommerce and online marketing initiatives, GameStop will begin carrying FTX gift cards in select stores. During the term of the partnership, GameStop will be FTX’s preferred retail partner in the United States. The financial terms of the partnership are not being disclosed.

September 21, 2022 FTX US will be GameStop's exclusive crypto exchange partner in the U.S. and GameStop will be FTX US's preferred retail gaming partner. Bullish?

September 23, 2022 AMA with Brett Harrison - President of FTX.US

November 1, 2022 GME x FTX LFG !!!!

November 6, 2022 Wtf is happening with FTX (GameStop partner)?

November 8, 2022 Binance just bought FTX as SBF says in a Twitter thread. What. Curious about the impact of FTX x GameStop partnership.

November 9, 2022 GameStop stops selling FTX.us gift cards on their homepage

November 11, 2022 - 65 days after forming a partnership with FTX - FT.US and all other 130+ affiliated companies file bankruptcy

On September 11, 2021, a post in an investor forum from 2004 was discovered and posted on Superstonk where it was subsequently read by hundreds of thousands of individuals and entered the conscious awareness of GME investors for the first time.

Original source for the post - March 7, 2004

This piece can also be found in the GameStop Due Diligence Library

The significance of the cellar boxing post is that it introduced an important concept that explained in detail some of the methods by which certain participants (e.g. market makers) could perpetrate a strategy of naked short selling against vulnerable target companies that, when executed successfully, resulted in the target company's demise and great profits for the perpetrators.

On October 17, 2022, Ryan Cohen tweets a photo of himself standing next to legendary activist investor Carl Icahn, with no further description provided.

Why did Ryan Cohen tweet a picture of himself standing next to Carl Icahn? Who took the photo?

Ryan Cohen once referred to himself on Twitter as "Ryan Cohen by day, Warren Icahn by night", which many investors took to mean that Ryan Cohen is inspired and motivated by the behaviors of legendary investors Warren Buffet and Carl Icahn, that his own strategy was some kind of hybrid of the strategies of those 2 individuals.

In the subsequent months following this tweet, much has happened. Bloomberg reported that Carl Icahn was short GME.

Hindenburg Research released a report insinuating that Icahn Enterprises was operating a "ponzi-like" scheme, and the price of $IEP tanked.

At the same time, BBBY investors have been speculating that Ryan Cohen has been working with Carl Icahn on a turnaround / merger / acquisition for Bed Bath and Beyond.

Regardless of what the current unknown reality is, it creates questions that billionaire Ryan Cohen would post a photo of himself standing next to billionaire Carl Icahn, making public the fact that there existed some kind of relationship between these 2 individuals and perhaps an alignment of interests.

On November 16, 2020 -- 90 days after buying approximately 10% of the company -- Ryan Cohen writes a letter to the GameStop Board of Directors and outlines his vision for the company.

Subject: "Maximizing Stockholder Value by Becoming the Ultimate Destination for Gamers"

GameStop, at this time, was indisputably suffering from serious problems that, if left unchecked, would have probably led to GameStop's demise. This letter provides insight into what RC's plan for turning around GameStop would look like.

Superstonk discussion of this topic, May 15, 2021

In the letter, RC emphasizes that for the company to succeed, it will need to fix the major problems that it had, and pivot towards "a technology-driven vision."

In the concluding paragraph, RC states that "RC Ventures is not interested in receiving a lone seat on GameStop’s ten-member Board."

Since writing the letter, RC proceeded to replace the entire board of directors with himself and former colleagues from Chewy, and on June 9, 2021, RC becomes chairman of the board of directors of GameStop.

From the discussion in the November 20, 2022 interview, RC and board "inherited a bunch of legacy everything, and under-investment across the entire business – people, the entire technology stack, just decades of neglect" that needed to be addressed.

As a shareholder without access to observe the inner workings of the company, it can be hard to assess all of the changes and improvements that have been made to the company.

What we have been able to observe is a significant improvement to the company's overall financial strength.

Under RC's leadership, among other things, the company has improved operations, eliminated practically all debt, and greatly reduced financial losses.

The company has also been working on various web3-gaming related technology initiatives, though these have yet to materialize into meaningful revenue growth.

TLDR: GameStop capitalizes on high share price to raise nearly $1.7 billion in cash across several months. This warchest reinvigorated the company by enabling it to clear out debts, overhaul legacy business components, fund new initiatives, and in general provide a cushion as the new leadership team began the monumental turnaround of the company.

On April 5, 2021, GameStop completed the first of 2 At-The-Market Equity Offering Programs (ATMs).

"The Company ultimately sold 3,500,000 shares of common stock and generated aggregate gross proceeds before commissions and offering expenses of approximately $551,000,000."

On June 22, 2021, GameStop completed the second of the 2 ATMs.

"The Company ultimately sold 5,000,000 shares of common stock and generated aggregate gross proceeds before commissions and offering expenses of approximately $1,126,000,000."

During the Ryan Cohen GMEdd interview, RC was asked:

"Founding a company poses a different set of challenges than transforming a legacy business. How are Chewy and GameStop different or alike?

RC responded: "They’re both contrarian. Selling, – you know there were all the comparisons with Chewy to pets.com, and then GameStop to Blockbuster, it was harder to raise capital at Chewy, it was, you know, every time we raised capital we basically had one option, when we were hiring was very difficult we were unknown quantity in Florida, I’d say at GameStop, you know, we’ve been able to raise capital, we’re fortunate that we were able to do two ATMs, it’s been easier to hire, being in the public markets and having that level of visibility... with GameStop it’s a known quantity already, and we’ve got a business and a foundation to build off of, but having said that, it’s a foundation that was under invested in for a very very long time and we’ve been working really hard to restore and rebuild that foundation."

By raising nearly $1.7 billion in cash, the possibility of any near term bankruptcy was eliminated.

In terms of debt, as of January 30, 2021, the company carried a total of debt of $362.7 million. As of May 1, 2021, the company carried a total debt of $48.1 million.

In the GMEdd interview, RC stated: "We inherited a bunch of legacy everything, and under-investment across the entire business – people, the entire technology stack, just decades of neglect and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under."

Having raised this money by completing these 2 ATMs, GameStop was now in a strong position to begin to fix problems and and steer towards a successful future.

As of the most recent quarterly results (July 29, 2023), GameStop holds $894.7 million in cash and cash equivalents, and practically negligible long term debt of only $23.6 million.

On November 20, 2022, an interview with Ryan Cohen and Joe Fonicello of GMEdd.com is published.

The following is a transcript from the interview, lightly edited for better readability (e.g., removed any instances of "um", "uh", things like that).

JF: Welcome to GMEdd's interview with the one the only Ryan Cohen. I'm Joe Fonicello your host for the next hour. Ryan serves as the chairman of GameStop and the manager of RC Ventures. Ryan, this is your first public appearance in over two years and the only time you've sat down with anyone for an extended interview like this. Why have you remained so quiet despite the attention?

RC: Well first of all thank you for hosting me, I've been incredibly impressed with a level of diligence that GMEdd has done for GameStop and for the community and I couldn't think of a more appropriate channel to have this conversation with. Secondly in terms of why haven't I done anything up until now, I haven't had time, I've been focused on work so. Sorry for my dog in the background, but I haven't had time to play I've been focused on work, so it's taking up all of my time.

JF: Before everything with GameStop, you were the founder and CEO of Chewy at the age of 25. Can you talk about what building Chewy meant to you and what you learned from that experience?

RC: Can you hear the dog in the background?

JF: That's perfect.

RC: It's a real dog by the way it's not just sound effects.

What did I learn from Chewy? Chewy was hard. We built Chewy in Florida, it was very hard to raise capital, we we're a bunch of nobodies. It's like three states basically account for like 75 percent of venture capital: New York, California, and Massachusetts, so raising capital was really difficult to Chewy, attracting talent was very difficult to Chewy,

especially being in in Florida the talent pool was pretty limited and we were selling 30 pound bags of pet food online and so that wasn't very popular either against the backdrop of pets.com, so, first everyone said pets you know this you can't make the unit Economics work selling 30 pound bags of pet food, and then once we had positive unit economics everyone said that Amazon was going to crush us, and neither of those things were true. But it was very very tough It's a low margin business, part of the secret sauce was just how we structured it, we had negative working capital, we took the business from like 200 million to three and a half billion, we burned through less than 150 million of cash even though we accumulated significant losses, so, we turned our inventory over faster than our payment terms, but granted, going ahead to head against Amazon selling 30 pound bags of pet food in the mail - tough business.

GameStop on the other hand, in many ways -- you know Chewy was like a new construction, we built the business from the ground up, knew the business inside and out, GameStop is different. We inherited a bunch of legacy everything, and under-investment across the entire business -- people, the entire technology stack, just decades of neglect and so it's hard to turn around a brick and mortar retailer that's under the kind of pressure that GameStop was and continues to be under, but that was also part of the attraction going into GameStop was that a transformation the likes of GameStop was was really unprecedented and I was motivated by that and, you know, similarly selling 30 pound bags of of pet food in the mail was also very unpopular and we figured it out so, yeah, I like tough things. I don't like to make my life easy for whatever reason.

JF: You've made yourself into a pretty prolific activist investor. Is RC Ventures evaluating other opportunities in this market and what do you look for?

RC: I'm always looking for opportunities. What do I look for? Yeah and of course I mean it's a better it's definitely a better environment and market to allocate capital today than it's been you know in a very very long time at least in the past decade.

So I like consumer businesses, that's my core competency and you know I like simple businesses.

JF: How big is RC Ventures?

RC: You're looking at RC Ventures team.

JF: So why did you invest in GameStop?

RC: I invested in GameStop because I thought it was cheap I thought the intrinsic value of the business was worth more than the price that I paid, there was a tremendous amount of skepticism around GameStop and those are the things that I like.

I like looking at things where no one is looking at them. Those are usually some of the best opportunities.

And I'd say the opposite of that is IPOs where you know the animal spirits are out and everyone's kind of standing in line trying to give them money -- GameStop was on the opposite end of that.

No one was interested in investing in GameStop at the time that I made the investment it was hugely unpopular and those are the things that attract my attention. I'm contrarian by nature and so it was a pretty contrarian investment at the time.

JF: Yeah there are some contrarians online, what did you know about the enthusiasm from some retail investors over GameStop on digital communities like Wallstreetbets?

RC: I learned about, I mean I'd say I only really noticed that when I first filed my 13d -- I lost my 13d virginity in August of 2020. So I was a late bloomer, and that's when I noticed retail activity. And then when I filed subsequent amendments I noticed it, but it was something that snowballed over time and it was impossible to predict frankly. So obviously we know what happened, we know what happened afterwards in January, but you know I learned about it really when everyone else learned about it.

JF: Yeah last we spoke you refer to the events of January 2021 as one of the most fascinating things that has happened in the history of financial markets, and it was life-changing for us retail investors. What was it like for you?

RC: I was, when I decided to join the board personally, I made a long-term commitment to be at the company for an extended period of time, and so there was a lot of deliberations or I'd say board drama going on after I joined the board that really had nothing to do with the volatility in the markets and had everything to do just with the transformation and everything going on at the company, and so we changed the composition of the board, we got rid of the entire board we got rid of all the professional directors, we changed up the entire management team and so I was just I was focused on making all of the changes at the company and that consumed all of my time.

JF: Do you think what happened then could ever happen again?

RC: I don't know, I mean that's hard to predict what's going to happen in financial markets. Anything can happen. Anything can happen.

JF: When you think about the attention GameStop's received since then how has that impacted the company's transformation?

RC: It's great branding I mean there's no amount of money that can get the kind of branding that that we got from Gamestop, so, you know, it made the company world renowned, it brought a lot of attention to the company and, net I mean I think it was hugely hugely beneficial for the brand.

JF: Yeah I remember when that happened we made a post on GMEdd saying this is the great opportunity to rebrand all the stores across the globe to GameStop because that was just free marketing you know for everyone to know the GameStop name and you did end up changing Canada over to GameStop. So, founding a company poses a different set of challenges than transforming a legacy business. How are Chewy and GameStop different or alike?

RC: They're both contrarian. Selling, -- you know there were all the comparisons with Chewy to pets.com, and then GameStop to Blockbuster, it was harder to raise capital at Chewy, it was you know every time we raised capital we basically had one option, when we were hiring was very difficult we were unknown quantity in Florida, I'd say at GameStop you know we've been able to raise capital, we're fortunate that we were able to do two ATMs, it's been easier to hire, being in the public markets and having that level of visibility.

But in terms of the actual business that -- the business is more challenged at GameStop even if you look at the the cohorts and the customer retention, at Chewy selling consumables online we had really sticky customers and at GameStop it's completely completely different. You don't have sticky customers, so you know we had a payback period and a certain lifetime value whereas at GameStop you got to make back your money right away when you spend money on customer acquisition, so it's definitely a different dynamic.

Having said that though, if you look at GameStop and the brand and you know the store base and the strategic assets of the company, the size of the the customer database, you know there's a lot of strategic and just the revenue base frankly, I mean we needed to build that revenue base at Chewy, no one had ever heard of it, it was literally a customer by customer, whereas with GameStop it's a known quantity already, and we've got a business and a foundation to build off of, but having said that, it's a foundation that was under invested in for a very very long time and we've been working really hard to restore and rebuild that foundation.

On November 22, 2022, mods of r/wallstreetbets formally ban GME.

"WSB is a trading sub, not a place to baghold for years. Apes are no longer welcome."

This is an important development in the saga of GameStop / GME because it marks the point at which the media can no longer credibly pretend that the GameStop saga continues to be associated with the wallstreetbets subreddit.

There are many, many articles online that try to tell "the story of GameStop", and the story generally goes like this:

Redditors on wallstreetbets did some stuff, GameStop had a real short squeeze, it ended, it was this whole crazy frenzy you shoulda been there, AMC also did some stuff too it's very similar to GameStop. End of story.

For example:

cnbc.com - September 15, 2023 "The meme stock mania is now a movie. Here’s what has happened to GameStop and AMC", the complete story in its entirety by reputable and unbiased source CNBC: "on social media sites like Reddit’s WallStreetBets" "On Thursday, GameStop closed more than 78% below its all-time high." "The high level of short interest, and appearances by several meme stocks on the SEC’s “fail to deliver” lists, fueled theories from retail traders that there was “naked” or synthetic short trading going on. An SEC staff report on GameStop found no evidence of naked short selling, however." "AMC and GameStop" - "As for the meme stock companies themselves, it is still unclear whether the fundamental theories of some Reddit traders were correct." "The GameStop turnaround efforts of Chewy co-founder Ryan Cohen, who became something of a hero to the retail traders, have shown little sign of working. " "The financial results have also been underwhelming."

There was no mention that GME investors moved on to new subreddits, there was no mention that GME investors have directly registered 25% of the entire company, there was no mention that wallstreetbets, the place where everything happened and presumably continues to happen, formally banned GME discussions as of November 22, 2022. These things were not mentioned, because they never happened. It was just this whole thing on wallstreetbets back in 2021 with a couple of meme stocks, it was a frenzy, and then it just kind of fizzled.

And there you have it. The complete story of what has happened to GameStop as of September 2023 by CNBC.

The media will of course continue to generally ignore any part of what is actually happening that doesn't suit the narrative that they are trying to push. But, the longer that this whole story continues to unfold, outside of wallstreetbets, the less credibility that any reporting has that attempts to associate GameStop with that subreddit.

TLDR: this episode is a demonstration of how CNBC is aware of and sensitive to conversations that are happening among GameStop investors on Reddit, even though they continue to pretend that superstonk doesn't exist and that all discussions on Reddit about the stock market are happening exclusively on wallstreetbets.

On August 29 2022, there was a post on Superstonk of a clip from CNBC, where the host (Joe Kernan) abruptly ends the segment when the guest (Kristen Bitterly) mentions "shorts covering".

Joe Kernan: "Kristen you, I think, are in the camp that you weren't fooled by that summer rally, in terms of a new bull -- do you think it's a rally within a bear market?"

Kristen Bitterly: "We thought it was a bear market rally, when you look at what really was driving that rally there were a couple of different things, right, so the first was a lot of short covering, and when you look, there was that concept of did we actually..."

Joe Kernan: "Kristen we -- I'm sorry, but I've been told we've got to go immediately, we've got some issues, thank you. Squawk on the street's gonna be getting straight ahead. Thank you Kristen, we'll have you back."

Kristen Bitterly: smiles incredulously

This post by itself was an interesting example of behavior by CNBC that seemed to demonstrate a neurotic discomfort due to the guest discussing "short covering".

What was perhaps even more significant, was CNBC's reaction to the reality that this clip was being discussed. The CNBC segment that followed the very next day on August 30, 2022, in which CNBC hosts Joe Kernan and Melissa Lee try to explain away this behavior by CNBC that was being discussed on "Reddit".

Alongside a chyron that reads: "Reddit and weep; abrupt goodbye triggers conspiracy theories," the paid actors of a prominent financial media propaganda outlet complain for 2 minutes about people on Reddit taking things out of context.

Joe Kernan: "...I said it was a sad commentary yesterday, but [reddit users] will take a -- they will take that 20 seconds where I said 'we've got to go, to break', which, and I explained, to everyone: audio problems, no cameras at the --"

Melissa Lee: "It doesn't matter."

Joe Kernan: "None of that matters."

Melissa Lee: "Because they don't see -- they don't see the actual product. Many people online -- "

Joe Kernan: "All they see is something that's shared."

Melissa Lee: " -- they see the clip, and the clip goes viral, and you don't go to the original source, just the clip"

Joe Kernan: "And this all goes back to... Melvin Capital or something, and shorts, and, all she was doing was making a generic point -- someone was in my ear, I didn't even hear her point, she was making a generic point..."

Putting aside the claim that Joe Kernan explained to everyone that they were having "audio problems" and "no cameras at the --", which he in fact did not explain in the original clip, where on Reddit were these conspiracy theories being discussed? Which subreddits? While they normally claim wallstreetbets, in this instance, it was unspecified.

There was the post on superstonk with about 1.7k comments, and there was the post on wallstreetbets with about 800 comments. Despite that there was more than twice as much activity in the superstonk thread, and despite that it was posted in superstonk more than 2 hours before the post in wallstreetbets, because it was posted in both subreddits, CNBC could plausibly pretend, as usual, that when they mention "Reddit", they were referring to wallstreetbets and not the GME investor subreddit that shall never be acknowledged to exist.

It would, however, be foolish to believe that CNBC and other organizations are somehow very aware and sensitive to conversations that are happening on wallstreetbets but at the same time not aware of and sensitive to even larger conversations happening on superstonk.

They use wallstreetbets as cover to explain away whatever those zany Reddit kids are up to on any particular day of the week while continuing their deliberate media blackout of GameStop investors on superstonk and anything at all about DRS.

For example, if you go to CNBC.com and search for "wallstreetbets", you will get 312 search results. If you search for "superstonk", you will get zero results.

(Screenshots taken on September 18, 2023)

Superstonk? never heard of it.

Interestingly, also on August 30 2022, CNBC invited guest Kristen Bitterly back on to the show for some further damage control (superstonk thread, wsb thread), to pick up where they left off after the supposed technical issues,

Joe Kernan: "... now, I had asked you about the bear market uh rally that we saw, you started by saying 'I still believe it was a bear uh market, it's a bear market that we're in, and that was a rally', and you started ticking off some reasons for it and the first one I think you cited was short covering. So, -- now at that point we went to uh, you know we had to go to break, immediately, I mean it was unbelievable, but, let's just start there. You said one of the reasons is short covering. Expound please, and go as long as you want about short covering. As long as you want. You can go to 7."

Kristen Bitterly: "Absolutely" proceeds to spend the next several minutes talking about the market and glossing over short covering

Wanted to share it here as another chronological resource.

Bill Pulte is an independently wealthy individual and had a degree of popularity on Twitter for his philanthropy there, where he regularly gives away money to other Twitter users.

Around early April, 2022, Pulte and RC have some engagements on Twitter with respect to their mutual dislike of Boston Consulting Group. (Citation needed: is anyone able to find those early engagements?)

Pulte tells the story about how his grandfather's company PulteGroup was eventually infiltrated by BCG due to poor decision making by the CEO at the time. Pulte had to step in and fix the problem.

Up to this point, Pulte was somebody who was not generally known by GameStop investors. But because Superstonk gave much attention to Ryan Cohen's engagements on Twitter, eventually this attention connected with Pulte.

On April 9, Pulte shows up in Superstonk and begins to engage with the community there.

Although some expressed skepticism, over time Pulte demonstrates himself to be an ally of GME investors, and becomes one himself, and states that GME is more than a stock, it's a movement.

Here are some of the threads and tweets.

- April 9, 2022 - Hi it's Pulte

- April 10, 2022 - Pulte tweet's about promoting superstonk

- April 10, 2022 - Why Pulte is interested

- Apirl 11, 2022 - Pulte buys GME

- April 12, 2022 - AMA with u/RealPulte - grille me

- April 12, 2022 - Skepticism towards Pulte

- April 12, 2022 - Pulte and RC share a lawyer?

- April 12, 2022 - "I do believe RC is gonna turn it around."

- April 14, 2022 - Pulte attacked for boosting GME

- April 15, 2022 - "Be on the look out for Scammers and Grifters on Reddit SHORTING GameStop!"

- April 18, 2022 - Pulte buys GME even harder

- May 15, 2022 - "Yes GME is more than a stock, it's a movement"

- July 21, 2022 - "MOASS. SOON."

- September 6, 2022 - Pulte regarding the liars

- October 28, 2022 - "Still ❤️ $GME"

- May 11, 2023 - Anything can happen

- May 17, 2023 - Pulte learns about DRS book

- May 23, 2023 - Pulte regarding Computershare issues

This is by no means an exhaustive list of all relevant Pulte engagements. If there are any important ones that might have been missed please include them here.

On December 8, 2021, GameStop published their quarterly financial results for Q3 2021, and in the 10-Q form there is the line:

As of October 30, 2021, 5.2 million shares of our Class A common stock were directly registered with our transfer agent, ComputerShare.

This was the first such quarterly financial document from GameStop that mentioned directly registered shares. For the proponents of DRS among GameStop investors on superstonk and elsewhere, this was majorly validating. Here's a thread about that.

Up until this point, DRS was a relatively novel idea that was only really discussed online among GameStop investors, and didn't have really any genuine validation from a credible prominent source, perhaps except from Susanne Trimbath if she is considered prominent. On superstonk and elsewhere it was an idea that was also accompanied by a great amount of fear, uncertainty, and doubt, as well as other competing ideas / narratives.

For example, around this time there was a growing contingent of investors within superstonk following the influence of reddit user gherkinit. For the reasons that: he was influential (perhaps you could say an "influencer" of sorts) because he was a prominent poster within the subreddit, and ran a for-profit YouTube channel, and was using Superstonk to recruit an audience, and was largely focused on technical analysis and short-term price movements of the stock, AND, perhaps most notably, was also generally anti-DRS when prompted, that antagonism towards this individual and his followers started to grow within the community. Here's a thread about that.

By reporting the number of shares that had been directly registered up to that point, this was confirmation from the very company itself that the number of directly registered shares of GME is information that is worth publishing for all to know, including the investor hivemind. If this information was not important or worthwhile, they wouldn't be publishing it. This arguably solidified the consensus of the idea that DRS, true share ownership, was an important and worthwhile endeavor for GME investors, and was a major victory for DRS proponents in the ever-present competition of information and ideas.

It had been 314 days since that fateful day on January 28, 2021, when incumbent institutions, upon finding themselves in an unwinnable position within their own game, dramatically deployed the financial market chicanery of turning off the buy button for GME and other stocks. GameStop investors were cheated out of a legitimate investing victory that was based on a valid thesis and incredible momentum in the market. After 314 days of the hive mind investigating and learning and discussing this dramatic situation, hundreds of thousands of individual investors responded by wielding a newfound tool, with the consensus that shares of GME that they paid for with their own money should be owned by them, and that the action of directly registering those shares with GameStop's transfer agent (Computershare) was required in order to obtain true share ownership.

TLDR: This day marked a significant victory for GameStop investors and an escalation of the high stakes financial clash that is happening between GameStop investors and all of their opponents.

On January 27, 2021, according to historical trading data, the trading price of GME reached an all time high of $380 pre-split or $95 post-split.

On this day, DFV posted an update of his GME holdings valued at approximately 48 million dollars.

It was this relatively extreme trading price that attracted an enormous amount of attention on social media and in mainstream media, and was the peak of the GME sneeze.

Although Wikipedia is one of the most neutral sources of information that exists, this event is referred to there as the "GameStop short squeeze". It is the view of many GameStop investors that this is a misnomer, that it wasn't actually a short squeeze. Did short hedge funds close their short positions? If they didn't, then it wasn't really a short squeeze was it?

It wasn't until the next day, on January 28 when numerous stock brokers (in conjunction, and at the direction of who?) disabled the ability of customers to buy more shares of GME.

Since this peak, there has been a great deal of attention and many different narratives created about the GameStop saga. Certain parties out there would have you believe that this peak was just a flash in the pan, and that you should probably forget GameStop. But GameStop investors here and elsewhere know that the saga is far from over.

On January 28, 2021, one day after the trading price of GME reached an all time high of $380 pre-split (according to historical trading data), in one of the most dramatic events in stock market history, numerous stock brokerages disabled the ability of customers to purchase additional shares of GME.

It was this dramatic action that succeeded in destroying the momentum that was causing the trading price of GME to soar continuously upward, and ultimately putting an end to the sneeze of January 2021, an event that subsequently received a congressional hearing , investigations into Robinhood and other entities, multiple documentaries, TV shows, and soon the Dumb Money movie.

As investors of GameStop have subsequently come to learn, the January 2021 sneeze cannot be properly understood without realizing that the conditions that existed to enable such a dramatic event necessarily happened in an environment of systemic financial fraud that includes egregious naked short selling and failures to deliver.

If they did not take the action to shut off the buy button, then every short hedge fund, and also larger financial entities including brokerages and even market makers, would likely have faced bankruptcy and total destruction. As Thomas Petterfy of IBKR said, "we have come dangerously close to the collapse of the entire system, and the public seems to be completely unaware of that, including congress and the regulators."

By shutting off the buy button they succeeded in delaying such destruction. But this has instead resulted in GameStop investors continuing relentlessly in the pursuit of the truth and understanding and ultimately towards DRS.

As of the most recent financial report (Q1 2023), roughly 25% of all officially issued shares of GME are owned by about 200,000 individuals who have directly registered their shares of GME with GameStop's transfer agent Computershare.

The GameStop saga is far from over, but most financial propaganda would have the world believe that it ended not too long after the buy button was turned off. For what benefit would they want the masses of the world to believe that it is over?

Hello everyone,

I am pleased to introduce gmetimeline.org.

The purpose of this website is to provide a perspective of the GME saga in the form of a chronological overview of factual events, for GME shareholders and anyone else that might be interested.

As everyone here would understand, the GME saga is ever-changing and incomplete. As this story continues to unfold, I believe that it is important to have a tool such as this that attempts to unify all of the various sources of information (e.g. news reports, social media discussions, media publications, etc.) into a perspective that is easy to navigate and make sense of.

Somebody else in the past has already created gmetimeline.com, which itself is a great resource except for the fact that it has not been updated since the end of 2021. I believe in the value of having such a resource so in a sense I am picking up where they left off.

This website is still in the early stages and still requires a lot of work. It is currently missing many events relevant to the saga that should probably be included. It does not currently have all of the functionality that I believe it should have, such as the ability to filter events by their properties (e.g. type, significance, tags), as well as additional functionality such as a representation of GME share ownership distribution such as can be found in the chart at the bottom of the page at https://www.drsgme.org/why-gme, or in the past at computershared.net. Also, the website is currently mostly intended for full-size PC screens and not optimized for mobile, so that is something that will require additional work as well.

Also, I wanted to be able to have a community area to discuss events that are now historical, but, for reasons I discuss in this post, I believe that the most appropriate area for such discussions is here on this Lemmy instance.

I will be using this community to create threads to serve as supplementary discussions specifically for historic events.

So, please feel free to use this community as a place to discuss any historic events of the GME saga that might deserve further attention or discussion. Please also feel free to use this community to specifically discuss the gmetimeline.org website, such as suggestions for content or anything like that.