Lol malta being last is so fitting.

YUROP

A laid back community for good news, pictures and general discussions among people living in Europe.

Other European communities

Other casual communities:

Language communities

Cities

Countries

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- https://feddit.dk

- [email protected] / [email protected]

- [email protected]

- https://lemmy.eus/

- [email protected]

- [email protected]

- https://foros.fediverso.gal/

- [email protected]

- [email protected]

- Italy: [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- Poland: [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

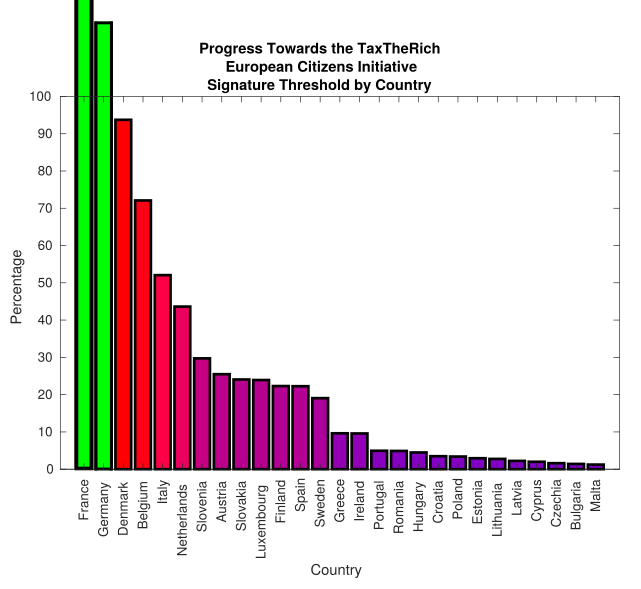

The petition also needs to go over 1million signatures. So French and Germans signatures help as well.

Europeans don't care. they just want to complain.

P.S signed

Maybe they don't hate the rich?

The question is: Why should I care?

is it fair being born with wealth that pays you a daily interest that others work for a whole month?

If this wealth was legitimately earned by your parents? Yes it is fair. Supporting your children is your sacred right.

Please explain how one legitimately earned 10 Million.

Usually by starting a company that produced valuable goods and services benefitting everyone and profiting off of it.

You can also gamble but thats by definition a losing game

sounds quiet unusual to be honest

sounds quiet unusual to be honest

I think it's the most common road to be a millionaire.

Microsoft - Bill Gates Amazon - Jeff Bezos Berkshire Hathaway - Warren Buffet CDProjekt - Adam Kiciński, Marcin Iwiński (They started from absolute nothing, bazar stand with bootleg software) TOYOTA - Akio Toyoda, branched out from family buisness in textile industry

Literally every single successful business made it's founder a fortune

- Microsoft: monopolist founded with a "small loan"

- Amazon: monopolist founded with a "small loan"

- Berkshire Hathaway - founded by a congressman's son with access to wealth and education

- CDProjekt, wow an outlier!

- TOYOTA - generational wealth

Literally every single successful business made it's founder a fortune

LMFAO "the winners won". Any other tautologies you want to spout? "The losers lost" maybe?

Even if you had access to the capital, you'd most likely fail - because running a business is hard

For every Bill Gates or Bezos there are dozens if not hundreds who sunk the entire initial investment.

You hate survivors for some reason.

"valuable goods ... benefiting everyone" not on the cost of others is what's lacking here

valuable goods ... benefiting everyone

If other people are buying what you produce, in almost every case you produce something valuable, and a person who buys from you benefits.

There are exceptions - drugs, weapons, slot machines ect.

But basically everything you see around yourself that was made by man, was produced by a successful business, and bought by somone who needed it.

you missed something when citing me

not on the cost of others

not on the cost of others

It's not on the cost of others, its a fair exchange. Both sides benefit

And the people in the middle? Sure, the people exploited for the production of those goods benefited a lot. The child forced to harvest coffee and chocolate really enjoyed the transaction.

The child forced to harvest coffee

It's fault of their governments

Hey ho I have a paper for you

We demonstrate that chance alone, combined with the deterministic effects of compounding returns, can lead to unlimited concentration of wealth, such that the percentage of all wealth owned by a few entrepreneurs eventually approaches 100%.

...note no skill required. Conversely, hustling won't get you there.

We show that a tax on large inherited fortunes, applied to a small portion of the most fortunate in the population, can efficiently arrest the concentration of wealth at intermediate levels.

So we don't even have to hit millionaire kids. Inheriting 5-10 million a head is fine, systemically speaking. And if you think that your kids are better off with more money I sincerely feel sorry for you.

...note no skill required. Conversely, hustling won't get you there.

You didn't read that paper. From fast skimming I can clearly see that their simplified model didn't check for impact of skill at all.

It says nothing about real world except there's a wealth concentrating factor of being ahead. Other factors are ignored

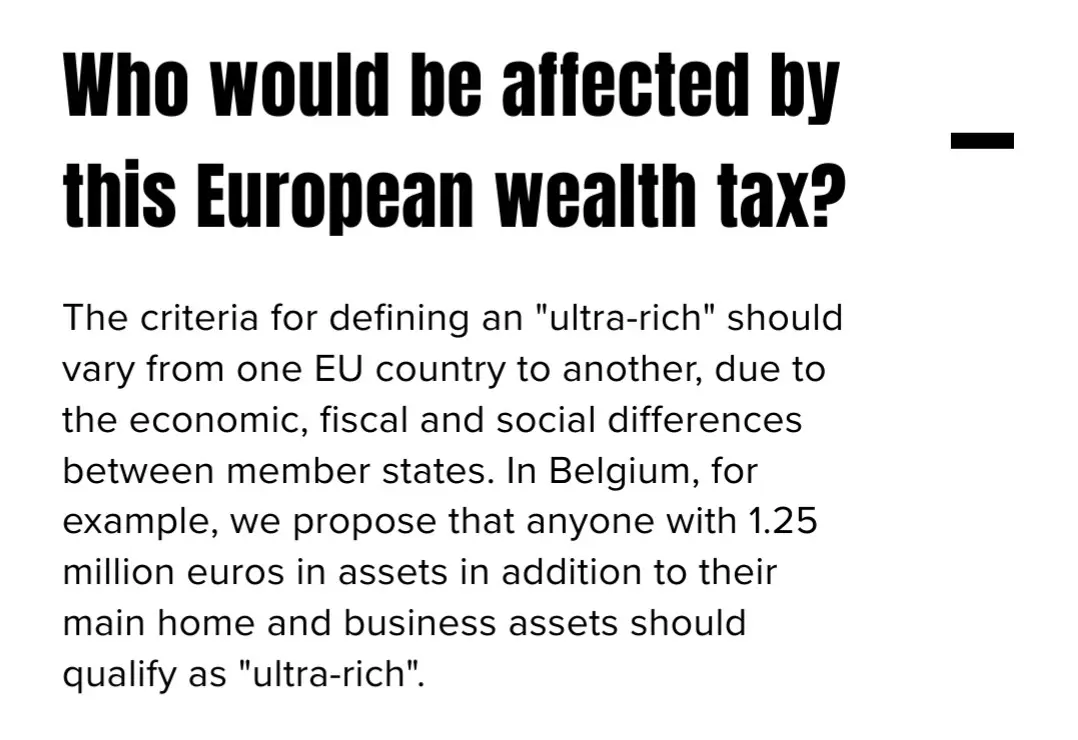

From https://www.tax-the-rich.eu/home#info

What a bad initiative. This would basically guarantee that people in Europe can't ever retire on a modest income.

1.25 million euros per person on top of your main home doesn't allow you to retire?

It's probably not so much you can't retire, but you can't retire with an income that you'll be comfortable on.

A brief look suggests the average pre-tax wage in Belgium is around €3800, or about €45000 per year. Assuming you already own your home, or continue to pay mortgage payments at the same rate as before retirement, your pension needs to roughly match your income to not have a drop in living standards. A €1250000 pension pot will buy an annuity that pays a bit more than that, probably around €55000 a year, but assuming you amassed that in your pension pot you would probably have been on a higher than average salary, so it's going to be close, and an annuity at that level wont increase with inflation, so your buying power drops over time, just when you're more likely to need a care home or nursing support.

Belgium has public pensions with a minimum of €1,549 per month (https://www.brusselstimes.com/344282/monthly-pension-in-belgium-to-top-e1500)

You seem to assume that 1.25 millions is supposed to be your only income, but that's not the case.

A really rough calculation (and I acknowledge I could be somewhat off here) suggests that if you contribute for 40 years, and get around 5% interest per year, you'd need to put in an average of €10,000 per year to reach €1,250,000. Working out average salary progression through a working life is left as an exercise for the interested reader, but assuming you're putting 10% of your salary into your pension, you'd need to be earning six figures to make that pension pot, so a drop to around €73,000 including the public pension could be hard to manage.

As I said, not so much can't retire, as can't retire at the same standard of living, especially as annuity payments wouldn't increase with inflation.

Only people living in Malta are billionaires

This initiative is a total garbage for two reasons:

-

Taxing unrealized gains is immoral and a LOT of people won't ever sign this petition

-

Expect the great exodus of capital from the EU if such proposal ever passes.

Point 2 is always what people fear monger when taxes being raised is brought up.

Gerard Depardieu became russian citizen when France introduced 75% tax on his income

https://www.france24.com/en/20140530-exiled-french-actor-depardieu-pay-just-6-tax-russia

And this is just one high profile example. Im sure there were a lot more like him

Depardieu is a wanker who was practicing tax evasion long before he left.

We don't need useless piles of garbage like him.

We don't need useless piles of garbage like him.

You do want his money tho - hence the attempt of 75% tax rate. But you aren't getting any of his income, he doesn't pay his taxes in france anymore.

It's ok, these faux french cunts can fuck off to another country. Makes room for people who actually care about the country.

We weren't getting any of this fraudster's money anyway.

If anything he cost us more money than anything in fake grants.

So you have a horrible legal system, and he's great scapegoat to divert attention from fraud underneath? Am I missing something?

So....Elon musk instead of paying $0 income tax as an American citizen would pay $0 as an expat?

paying $0 income tax as an American

Let me guess - he borrows against his assets so it isn't taxable income? That's a pathology in the legal system. He should absolutely pay regular income tax on this. But regular income tax isn't the same as proposed wealth tax

That is the thing that need to change, but how do you legislate that without fucking up the little guy with 100k in 401k. Or the random dude making HELOC that's going to be taxed harshly?

That is the thing that need to change, but how do you legislate that

Simple, when he dies, during the inheritance proceedings, all debts should be paid off from the sold assets, and the due income tax collected as if he sold these assets himself when he was alive, creating the taxable income.

LMAO, you think they pay inheritance?

Also, what a solution: let them extract wealth and not pay for 80-100 years. Then we can finally do something. Do you even realise how ridiculous that sounds?

LMAO, you think they pay inheritance?

I think they do.

Do you even realise how ridiculous that sounds?

It's not ridiculous - they're accumulating interest on that debt. The more interest the have to pay, the bigger taxable income in the end. It's a great long term investemnt for the state