this post was submitted on 28 Aug 2024

8 points (100.0% liked)

YUROP

1210 readers

5 users here now

A laid back community for good news, pictures and general discussions among people living in Europe.

Other European communities

Other casual communities:

Language communities

Cities

Countries

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- https://feddit.dk

- [email protected] / [email protected]

- [email protected]

- https://lemmy.eus/

- [email protected]

- [email protected]

- https://foros.fediverso.gal/

- [email protected]

- [email protected]

- Italy: [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- Poland: [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

founded 9 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

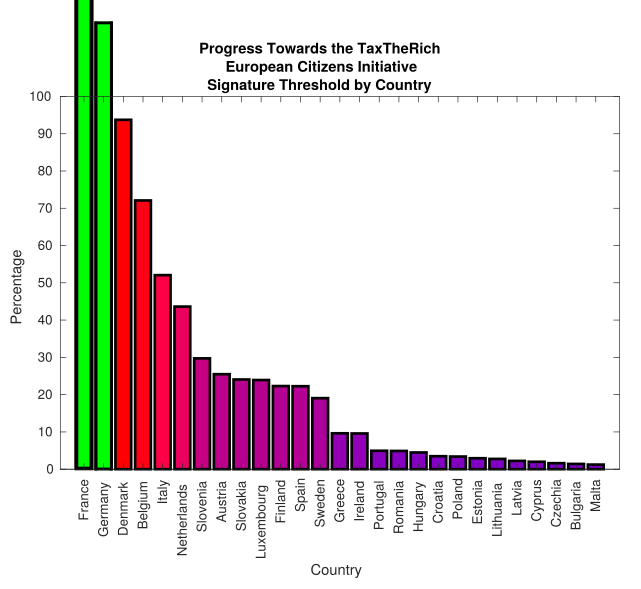

From https://www.tax-the-rich.eu/home#info

What a bad initiative. This would basically guarantee that people in Europe can't ever retire on a modest income.

1.25 million euros per person on top of your main home doesn't allow you to retire?

It's probably not so much you can't retire, but you can't retire with an income that you'll be comfortable on.

A brief look suggests the average pre-tax wage in Belgium is around €3800, or about €45000 per year. Assuming you already own your home, or continue to pay mortgage payments at the same rate as before retirement, your pension needs to roughly match your income to not have a drop in living standards. A €1250000 pension pot will buy an annuity that pays a bit more than that, probably around €55000 a year, but assuming you amassed that in your pension pot you would probably have been on a higher than average salary, so it's going to be close, and an annuity at that level wont increase with inflation, so your buying power drops over time, just when you're more likely to need a care home or nursing support.

Belgium has public pensions with a minimum of €1,549 per month (https://www.brusselstimes.com/344282/monthly-pension-in-belgium-to-top-e1500)

You seem to assume that 1.25 millions is supposed to be your only income, but that's not the case.

A really rough calculation (and I acknowledge I could be somewhat off here) suggests that if you contribute for 40 years, and get around 5% interest per year, you'd need to put in an average of €10,000 per year to reach €1,250,000. Working out average salary progression through a working life is left as an exercise for the interested reader, but assuming you're putting 10% of your salary into your pension, you'd need to be earning six figures to make that pension pot, so a drop to around €73,000 including the public pension could be hard to manage.

As I said, not so much can't retire, as can't retire at the same standard of living, especially as annuity payments wouldn't increase with inflation.