The value of everything changes. Time is not static. What maybe useless today may be of great value tomorrow and that value has to be tracked.

A system without money is just a system where the actual currency isn't obvious.

A "Showerthought" is a simple term used to describe the thoughts that pop into your head while you're doing everyday things like taking a shower, driving, or just daydreaming. A showerthought should offer a unique perspective on an ordinary part of life.

The value of everything changes. Time is not static. What maybe useless today may be of great value tomorrow and that value has to be tracked.

A system without money is just a system where the actual currency isn't obvious.

I never understood why inflation was a good thing. I understand why it happens. But I can't wrap my head around the value of your money going down being good.

Maybe so you actually spend it. But then it also keeps you from saving up for bigger purchases or having some emergency money tucked away.

Because inflation applies to both the amounts you owe and the ammounts you save. It's kinda baffling to see multiple people here arguing that inflation encourages hoarding or not spending. Specifically it does the opposite. Money you save loses value, so you need to invest in something that returns value faster than inflation rather than sit on a pile of cash. Money you borrow also loses value, so the money you pay back later is less than the amount you borrowed. If you pay the same amount each month for your mortgage for 25 years and inflation is 2% each year the last payment should be half as valuable as the first (edit: about two thirds, actually. Maths!), so you're encouraged to buy on credit.

More importantly, governments have tools to control inflation, so they can intervene and course correct when sudden imbalances happen. The anarchocapitalist fantasy where the market balances itself is extremely dumb, government intervention is absolutely needed, and tools to regulate runaway effects are what keeps all your savings from evaporating every so often.

If you pay the same amount each month for your mortgage for 25 years and inflation is 2% each year the last payment should be half as valuable as the first (edit: about two thirds, actually. Maths!), so you’re encouraged to buy on credit.

But this is only meaningful if your income is also going up, right? Otherwise you're still getting fucked by inflation. You're paying the same percentage of your income towards that mortgage but all your other expenses are going up.

Absolutely. Inflation isn't just inflation, different things move at different rates, and that includes salaries.

But that's why you want collective bargaining and an ongoing conversation about salaries, including periodic revisions of minimum wage regulations. We shouldn't let oligarchs tell us that inflation is what degrades salaries, it's the mismatch between salary growth and inflation. Inflation should be part of the calculation and salaries should be negotiated on a regular basis and regulated to prevent the system from breaking at the bottom.

In general, there's pros and cons to both. Iirc inflation is considered to be a bit better than deflation because deflation is linked to economic crisis, high unemployment, low productivity, and low sales. Inflation isn't much better but having a very small amount of inflation is more manageable and has some benefits.

I'm not sure it's "good" on its own, it's maybe more that the alternative (deflation) is worse. A steady value might be preferable but I'm not sure that's realistic, so a small amount of inflation is probably the best you can hope for? 🤷

The idea that a little inflation is better than none comes from the thought that money should be changing hands as much as possible, and if money kept its value people would be incentivized to save all their money and keep it to themselves, and that would remove it from the economy. But if the value of that cash goes away people will want to invest it in something that might not lose its value, like a service.

Idk that's just the way it's always been explained around me I'm not some money jockey

Problem with money is that money only have value when people are willing to exchange money for goods and services.

The moment that exchange stops, value of money plummets.

A very good analogy I saw in Charles Stross’ “Neptune’s brood” is that money is a concrete representation of an abstract debt. Exchange materializes that debt into a trade, which is where valuation happens. I’m pretty sure I just made a lot of economists justifiably angry though

Inflation incentives you to use the money. If there is no inflation or worse, deflation, you money is worth more tomorrow than it is today so you're better off holding back on all purchases until later when your money is worth more, market moves slow or not at all.

I guess a little inflation is good,

to prevent all money from ending up in a single party's hands.

However that's the only upside I could think of, other then that I fully agree with you.

Central/regional banks "printing" money, through bonds and fractional banking, is blatant stealing from people who worked / saved in the past imo. Since it leads to inflation / devaluation of the currency.

to prevent all money from ending up in a single party’s hands.

Inflation encourages and amplifies wealth accumulation.

It does the opposite lol it encourages investment

to prevent all money from ending up in a single party’s hands.

I beg to differ.

Example: suppose you own property, gold, a business, or something else with tangible value. When inflation causes cash to decrease in value, your assets are safe. They have intrinsic value.

Example: suppose you're living a lifestyle where you can't afford assets like that. Maybe even living paycheck to paycheck. You make the same money, and you can buy less with each paycheck. You can't start buying assets when money keeps getting tighter.

I think it's pretty simple to see inflation only hurts the have-nots, while others are protected by the value of their accumulated assets.

I think it’s pretty simple to see inflation only hurts the have-nots

It hurts have-nots, but also medium to high earners who are forced to spend time to learn and to invest their money if they don't want to lose wealth. That destroys their productivity or their free time which hurts society as a whole.

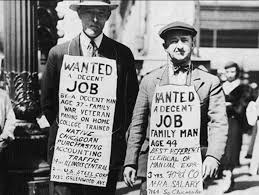

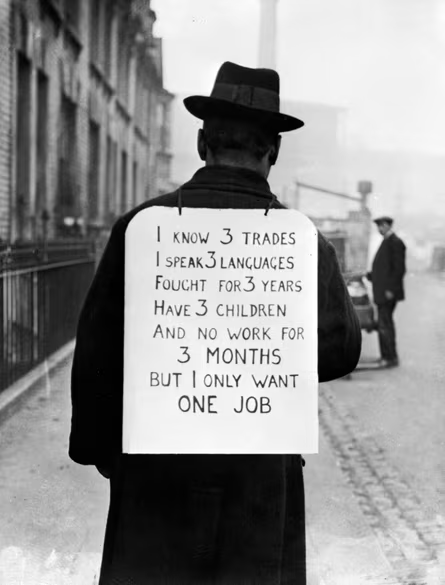

Throughout the 1800s, the us saw increasingly more severe and more frequent economic boom and bust cycles. This helps the wealthy as they are the ones who can buy up all the assets during the busts, and the common man gets fucked. This all culminated with the great depression. Its something like 20 recessions of 15% or more retractions between and 1930.

When the fed was given teeth to actually control the fractional reserve system., we've seen constant inflation, but the number and severity of economic recessions has gone way down.

We've seen 1 retraction over 15% since 1940. And that was because of COVID lockdowns.

This small, controlled inflation is great for the regular joe because it creates stability. And it was all going well until deregulation during the 80s.

If the amount of money was small and finite, one person could hoard most of the entire supply of money, and because the rest of society can't use their currency as easily to trade, there's less value in the utility of it. The entire purpose of cash is that it's a universal store of value so that you don't have to trade goods for goods and instead trade cash for goods. Nobody would use cash if they can't ever have enough to purchase what they need in the increments they need.

Disclaimer: this is just my intuition; I am not an economist

Short answer: Inflation encourages spending, because if you don't spend it, it will be worth less in the days, weeks, years ahead as inflation eats away at the value. If your money is worth more by saving (deflation), then you wait to spend because the thing you want to buy will be cheaper tomorrow, and cheaper yet the next day. If people stopped spending the economy grinds to a halt. Everyone loses their jobs.

I hear this very often, but has this ever been proven? People are not exactly going to stop eating or paying rent which already eats more than half of people's income. I could see gambling and entertainment become more stale, but I'm not sure how big of a problem this is.

Yes, not all demand is the same, but the idea isn't to increase the demand of bread, it's to increase investment. If sitting on cash gets you more interest from the bank you're going to let it sit more. If it loses value you're going to spend or invest it more. And yeah, this does happen, among other things because inflation affects everybody, not just consumers, although this also influences how likely individual people are to buy things on credit. Companies and governments also care about this.

As always with economics things aren't straightforward, and you get lots of weird paradoxical behaviors, but the big lines of this one are easy to see. If you have some inflation and low interest rates you're gonna be more likely to make big purchases or investments on credit. And the real problem is once you have those and are paying them back if inflation flips and suddenly the 100 bucks you pay each month for that credit go up in value to 110 you may find yourself losing money on that investment or being unable to afford it, which is a big problem when that happens to literally everybody who owes money (including the government) all at once.

And since the people you owe money to are mostly just a handful of banks.... well, that's not a great wealth redistribution technique, is it?

I hear this very often, but has this ever been proven?

Yes, multiple times we've seen this play out in real life. The most recent big one would be Japan 1990s. Look up "The Lost Decade". The biggest one in the USA was the Great Depression in the 1930s.

People are not exactly going to stop eating or paying rent which already eats more than half of people’s income.

You stop buying all but the absolute basics (bulk beans and rice and nothing else?), so all the food that isn't a "basic" goes un-bought and the people producing that food/product lose their jobs. Then you stop buying food when you're out of money, which is what can happen in an extreme deflationary environment because you have no income, because you lost your job, because no one buys whatever your work produces.

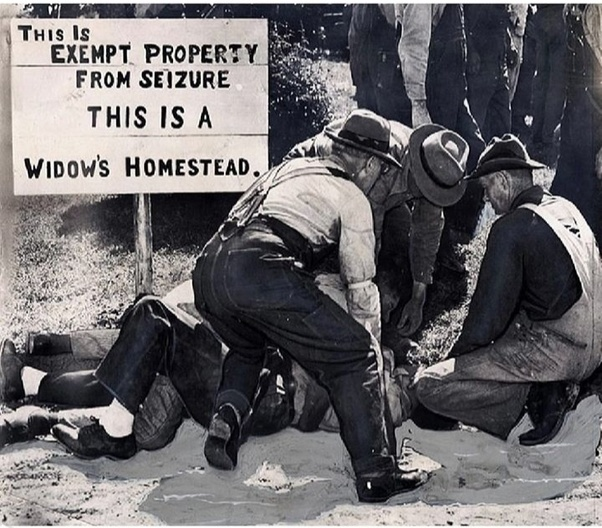

And if you stop paying rent, you're going to get evicted. If you stop paying your mortgage, the bank will take your home. This played out exactly this way during the Great Depression.

I could see gambling and entertainment become more stale, but I’m not sure how big of a problem this is.

Its much more than just those sectors, but just imagine how many jobs are in the gambling and entertainment business. Now all of THOSE people are out of work competing with you for whatever jobs remain. That, too, happened during the Great Depression.

I see. That makes sense.

It's funny that people always talk about inflation vs deflation and never mention what would happen with a fixed price for everything... No urge to spend but no urge to save for later either, spend money if you want, don't if you don't, doesn't matter, you'll be able to purchase the same thing for the same amount months from now.

It’s funny that people always talk about inflation vs deflation and never mention what would happen with a fixed price for everything

Its mentioned pretty early when learning economic theory, and its disastrous, which is why it isn't suggested as a policy to put into place, though from time to time some governments do, and its, as expected, disastrous.

Lets imagine you're a livestock farmer and there is a fixed price for two types of meat you produce: Beef and Frogs. In our theoretical country of FakeLand, we use the SuperCoin (SC) currency I just made up.

Now, you (and most people) like eating beef and very few people like frog. So the start of the Year 1 opens and your beef sales are VERY busy, and you're selling just a tiny tiny big of frog. If this keeps up, you're going to be out of beef very quickly, and you're going have LOTS of spoiled frog meat. In a normal economy, you would reduce the cost of frog from 8 SC, to possibly 5 SC making it half the cost of beef, so you could clear out your inventory of frog before it goes bad, BUT YOU CAN'T IN FAKELAND, because the prices are fixed! So for Year 1, nearly all your frog meat goes unsold and spoils and you lose 4 SC for every unit of frog you didn't sell. You sold all your beef, but with your losses on frog meat, you're near poverty because you essentially only earned 1 SC when you sold a unit of beef because you had to cover the losts of 4 SC for a unit of unsold frog meat.

So next year, you learn your lesson, right! Less frog meat, and more beef!

Year 2

You still can't do anything with the prices you sell for, because Fakeland sets the fixed prices.

So you're all ready to make tons of SC on beef, except there is a disease that wipes out 90% of everyone's herds before it goes to market. In a normal economy supply and demand would make the cost of beef rise to maybe 20 SC or 30 SC to recognize the scarcity of beef, but here in Fakeland the prices are fixed.

In the first month of Year 2 selling, you sell out of beef lightning quick because beef is still relatively cheap at only 10SC! Because of the shortage of beef, people also willing to buy your frog meat. Since you only made 1/10th of that this year, you don't have that much of it either. In a normal economy supply and demand would let you raise prices on frog too way above 8SC to maybe 10 SC or 12 SC to help you cover your beef losses, but in Fakeland prices are fixed, so you can't. You sell out of frog in the first month too.

So, you now have another 10 months or so with nothing to sell. Further, you have money, but there's no food to buy from anyone because it all sold cheaply from fixed prices.

This is how government setting fixed prices on things that the cost and popularity vary on can play out. If you want to see real life recent examples. Here's where the Venezuelan government in 2020 fixed prices on foods and how disastrous it was.

Just to complement this whole idea. The economic crisis in Venezuela was setup when the currency got their prices fixed. Essentially making exchanging currencies illegal without government approval. This threw our economy into disarray and made us 100% dependent on oil sales, as it was the only consistent influx of dollars. When the global prices of oil crashed in 2014, they pulled the currency exchange prices with them, we got the highest inflation in history ever and our economy collapsed. In response, the government fixed prices of everything, specially food, not just the currency. The result was an even worse crisis, death and hunger.

The whole thing has been somewhat stabilized by now by, as you would guess, liberating the prices and letting the economy behave normally again.

Isn't price fixing different from 0 inflation though?

Isn’t price fixing different from 0 inflation though?

I suppose looking through some very narrow lenses perhaps, but practically speaking I don't think they're different in their effect on consumer behavior. Inflation occurs when sellers control their prices. Price fixing technically doesn't allow inflation. I say technically because nearly all systems where strict monetary policy occurs, economics is still active and buyers and sellers resort to black markets or the barter system. So in those places inflation can still run rampant even if official prices are fixed.

Do you have a different take?

Mostly because that's impossible. Ideally you want small inflation so it's a bad idea to just leave money around, but either way 0% inflation is about as impossible as 0.4999% inflation.

No wonder the degrowth movement exists. It's because of this bullshit that we harm everything around us.

No wonder the degrowth movement exists. It’s because of this bullshit that we harm everything around us.

Economists and those that made political theory have been looking for better alternatives since the formation of civilization.

What is your suggestion for a better system?

We're trying to describe the scarcity of something in units of something becoming less scarce every year. ftfy

There is no standardized unit of account which is not loosing or gaining value over time. However there are/were systems with more stable inflation rates than ours, like the gold standard in the US.

But the gold standard encourages hoarding money, rather than spending it, which could create even bigger wealth divides and less motivation to invest in new technologies.

Hoarding isn't even a gold based economy's biggest failing. There isn't enough gold in the world for it. The world economy would essentially be fixed to the physical amount of gold that is in the possession of human beings. Monetary policy would essentially be nonexistent and we're ride the unguided roller coaster of pure unchecked speculation. We used to do this in the USA, and the result helped lead to the worst economic catastrophe our country ever saw: the Great Depression.

For a practical experience, imagine we're on the gold standard wanting to buy a home. You go to the bank and ask for a loan. You get told the few people with spare money (because the amount of money is fixed to how much gold the USA has) want 75% interest on the money you're asking for to buy the house. There's no "prime" interest rate because a federal centralized banking policy doesn't exist. Maybe you can go to another bank and they only want 65% interest, but only have half the money you need to borrow. This is just one example.

For a business owner, if they can't get a loan to expand, they can't hire the 10 new people they want to create more widgets. With cash on hand they can hire 1 person, and then the business will have to grow much slower before they can hire the second or third person, rinse, repeat. Business growth is very very slow.

I get it, and I wish there was a more stable way to measure value internationally. Not for trade or anything, just a baseline. Something along the line of total global money value / total supply.

I've only thought about it casually, but everything I've come up with makes the concept more complicated. It spirals pretty quickly. Value in what? Gold? (no). Watt-hours? Who's energy?

I'm sure someone with an economics degree has gone absolutely nuts trying to figure something out. I'd be very interested to learn more.

I get it, and I wish there was a more stable way to measure value internationally. Not for trade or anything, just a baseline. Something along the line of total global money value / total supply.

I'm not understanding where you're going with this. What problem are you trying to solve? Lets say for a moment you did find this magical objective and fair international measurement method. What then? How would you use apply it?

Honestly? Sometimes my brain just runs with stuff like this. Having travelled enough, it gets really fascinating, what's expensive where and why. A universal value metric would be about as useful to me as the Kelvin scale is. It's nice to have it as a thought tool, but it's not particularly useful day-to-day.