Welcome to baby Marxist rehabilitation camp.

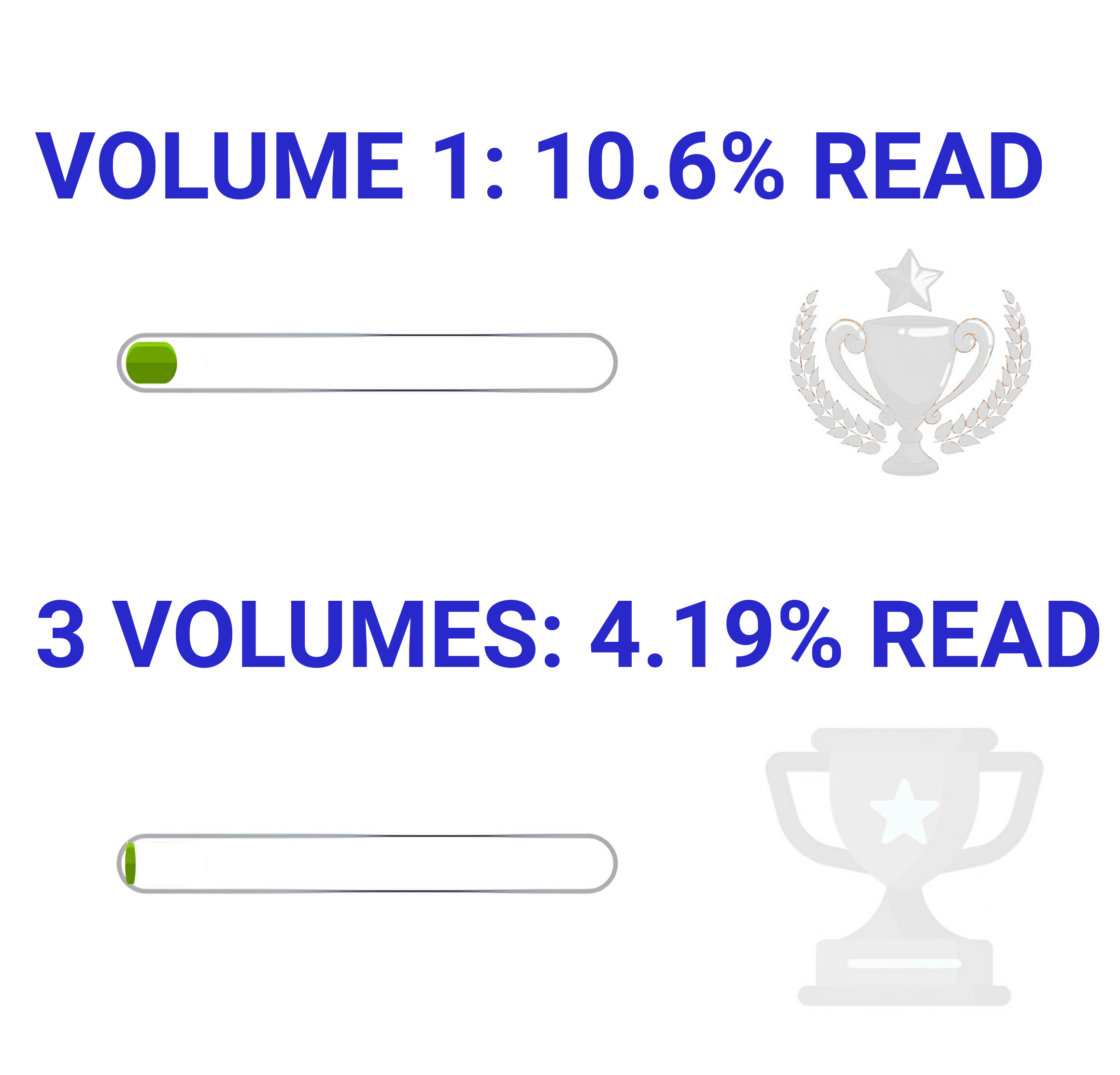

We are reading Volumes 1, 2, and 3 in one year. (Volume IV, often published under the title Theories of Surplus Value, will not be included in this particular reading club, but comrades are encouraged to do other solo and collaborative reading.) This bookclub will repeat yearly until communism is achieved.

The three volumes in a year works out to about 6½ pages a day for a year, 46⅔ pages a week.

I'll post the readings at the start of each week and @mention anybody interested. Let me know if you want to be added or removed.

Congratulations to those who've made it this far. We are almost finished the first three chapters, which are said to be the hardest. So far we have just been feeling it out, now is when we start to find our stride. Remember to be methodical and remember that endurance is key.

Just joining us? It'll take you about 4-5 hours to catch up to where the group is.

Week 3, Jan 5-21, we are reading Volume 1, Chapter 3 Section 3 'Money', PLUS Volume 1, Chapter 4 'The General Formula for Capital', PLUS Volume 1, Chapter 5 'Contradictions in the General Formula'

Discuss the week's reading in the comments.

Use any translation/edition you like. Marxists.org has the Moore and Aveling translation in various file formats including epub and PDF: https://www.marxists.org/archive/marx/works/1867-c1/

Ben Fowkes translation, PDF: http://libgen.is/book/index.php?md5=9C4A100BD61BB2DB9BE26773E4DBC5D

AernaLingus says: I noticed that the linked copy of the Fowkes translation doesn't have bookmarks, so I took the liberty of adding them myself. You can either download my version with the bookmarks added, or if you're a bit paranoid (can't blame ya) and don't mind some light command line work you can use the same simple script that I did with my formatted plaintext bookmarks to take the PDF from libgen and add the bookmarks yourself.

Resources

(These are not expected reading, these are here to help you if you so choose)

-

Harvey's guide to reading it: https://www.davidharvey.org/media/Intro_A_Companion_to_Marxs_Capital.pdf

-

A University of Warwick guide to reading it: https://warwick.ac.uk/fac/arts/english/currentstudents/postgraduate/masters/modules/worldlitworldsystems/hotr.marxs_capital.untilp72.pdf

-

Reading Capital with Comrades: A Liberation School podcast series - https://www.liberationschool.org/reading-capital-with-comrades-podcast/

: Say the line Marx

: Say the line Marx : M - C - M’

: M - C - M’

<---- me waiting for the capitalists to "give back voluntarily the greater part of the profit in order to begin the game again"

<---- me waiting for the capitalists to "give back voluntarily the greater part of the profit in order to begin the game again" "Ah, Superintendent Chalmers, welcome. I hope you're prepared for an unforgettable consumption of commodities!"

"Ah, Superintendent Chalmers, welcome. I hope you're prepared for an unforgettable consumption of commodities!" "Commodities are not the terminating object of the trading capitalist, money is his terminating object."

"Commodities are not the terminating object of the trading capitalist, money is his terminating object."