Welcome to baby Marxist rehabilitation camp.

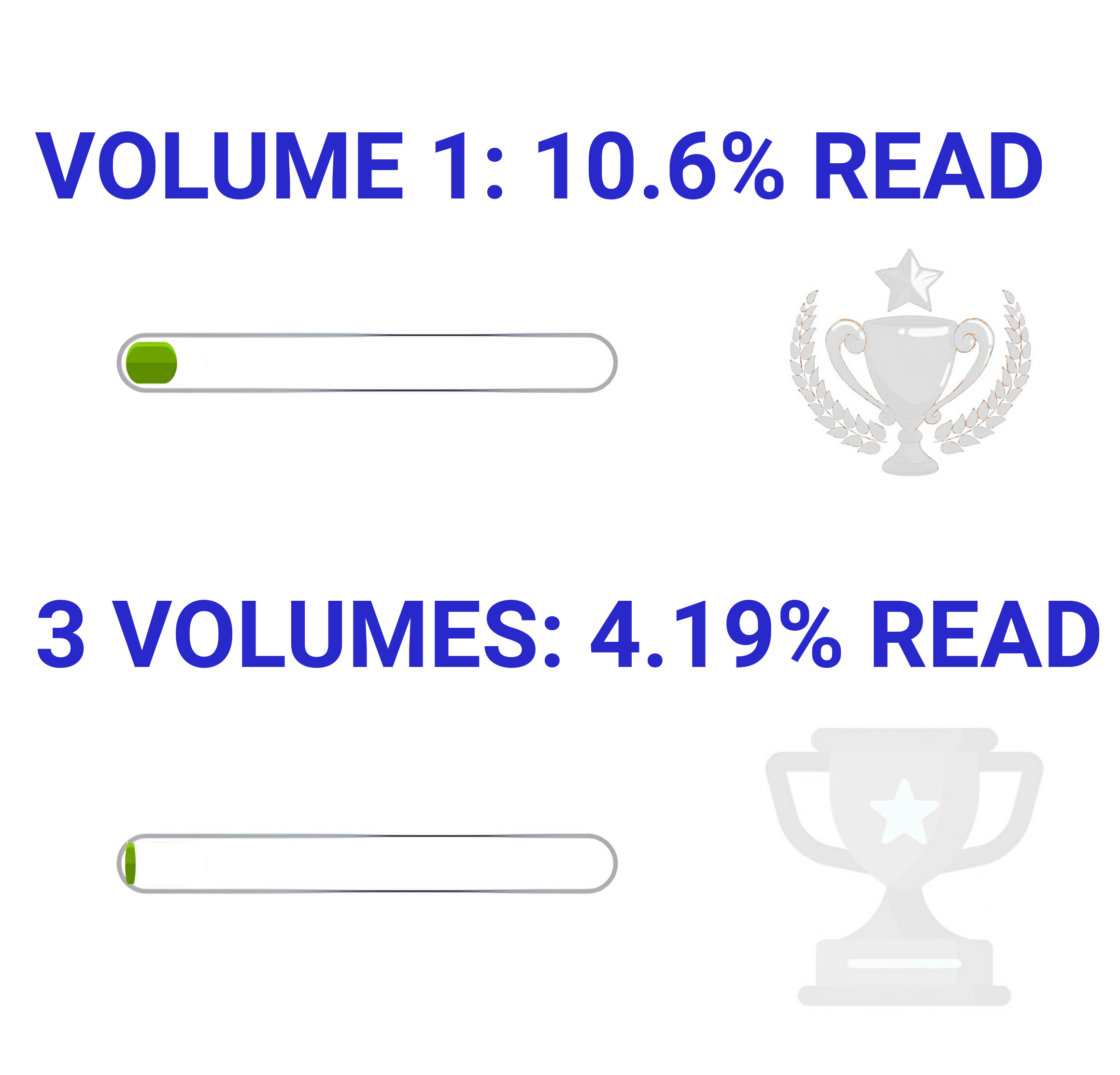

We are reading Volumes 1, 2, and 3 in one year. (Volume IV, often published under the title Theories of Surplus Value, will not be included in this particular reading club, but comrades are encouraged to do other solo and collaborative reading.) This bookclub will repeat yearly until communism is achieved.

The three volumes in a year works out to about 6½ pages a day for a year, 46⅔ pages a week.

I'll post the readings at the start of each week and @mention anybody interested. Let me know if you want to be added or removed.

Congratulations to those who've made it this far. We are almost finished the first three chapters, which are said to be the hardest. So far we have just been feeling it out, now is when we start to find our stride. Remember to be methodical and remember that endurance is key.

Just joining us? It'll take you about 4-5 hours to catch up to where the group is.

Week 3, Jan 5-21, we are reading Volume 1, Chapter 3 Section 3 'Money', PLUS Volume 1, Chapter 4 'The General Formula for Capital', PLUS Volume 1, Chapter 5 'Contradictions in the General Formula'

Discuss the week's reading in the comments.

Use any translation/edition you like. Marxists.org has the Moore and Aveling translation in various file formats including epub and PDF: https://www.marxists.org/archive/marx/works/1867-c1/

Ben Fowkes translation, PDF: http://libgen.is/book/index.php?md5=9C4A100BD61BB2DB9BE26773E4DBC5D

AernaLingus says: I noticed that the linked copy of the Fowkes translation doesn't have bookmarks, so I took the liberty of adding them myself. You can either download my version with the bookmarks added, or if you're a bit paranoid (can't blame ya) and don't mind some light command line work you can use the same simple script that I did with my formatted plaintext bookmarks to take the PDF from libgen and add the bookmarks yourself.

Resources

(These are not expected reading, these are here to help you if you so choose)

-

Harvey's guide to reading it: https://www.davidharvey.org/media/Intro_A_Companion_to_Marxs_Capital.pdf

-

A University of Warwick guide to reading it: https://warwick.ac.uk/fac/arts/english/currentstudents/postgraduate/masters/modules/worldlitworldsystems/hotr.marxs_capital.untilp72.pdf

-

Reading Capital with Comrades: A Liberation School podcast series - https://www.liberationschool.org/reading-capital-with-comrades-podcast/

I'll post my notes on the end of Ch.3 tomorrow. Flick me in the nuts if I don't.

I'd encourage everyone to post notes as they go . It helps everyone.

Ch.3 Section 3 'Money'

People don't sell (selling is C-M) to buy (M-C), but sell to accumulate money.

After you've satisfied your needs, your income gets hoarded. Hoarding slows the "metabolic" movement of C-M-C

'Nothing so evil as money ever grew to be current among men. This lays cities low, this drives men from their homes, this trains and warps honest souls till they set themselves to works of shame; this still teaches folk to practise villanies, and to know every godless deed' (Sophocles, Antigone)

"Ancient society therefore denounced it [money] as tending to destroy the economic and moral order."

"The class struggle in the ancient world, for instance, took the form mainly of a contest between debtors and creditors" – Michael Hudson writes about this.

"The hoarding drive is boundless in its nature. Qualitatively or formally considered, money is independent of all limits, that is it is the universal representative of material wealth because it is directly convertible into any other commodity. But at the same time every actual sum of money is limited in amount, and therefore has only a limited efficacy as a means of purchase. This contradiction between the quantitative limitation and the qualitative lack of limitation of money keeps driving the hoarder back to his Sisyphean task: accumulation. He is in the same situation as a world conqueror, who discovers a new boundary with each country he annexes."

As the demand for the quantity of money needed fluctuates, a buffer/reserve is handy. This is one purpose served by hoarding.

Deferred payment or selling on credit: this is C-M (selling) but the seller loses ("alienates") the C first, and gets the money later.

With deferred payment, the buyer:seller relationship becomes a debtor:creditor relationship. Money now has a 3rd function (in addition to means-of-transaction + measure+of+value) it is now a means of "payment", by which Marx means payment of debts as distinct from paying for chewing gum. When a person gets their paycheque, some goes to their creditors for debts/loans before they buy use-values.

"At first, therefore, these new roles are just as transient as those of seller and buyer, and are played alternately by the same actors. Nevertheless, this opposition now looks less pleasant from the very outset, and it is capable of a more rigid crystallization"

"The movement of the means of payment, however, expresses a social connection which was already present independently." (when I buy chewing gum, we are equals transacting for fun; when I pay off a bank loan, there is a power relationship.

Here Marx is starting to talk about classes. Creditors = bourgeoisie.

"The function of money as the means of payment implies a contradiction without a terminus medius. In so far as the payments balance one another, money functions only ideally as money of account, as a measure of value. In so far as actual payments have to be made, money does not serve as a circulating medium, as a mere transient agent in the interchange of products, but as the individual incarnation of social labour, as the independent form of existence of exchange-value, as the universal commodity" –This is a hard paragraph. I think it means that in instant transactions, money makes trade better. But with deferred payment comes hoarding ("The development of money as a means of payment makes it necessary to accumulate it in preparation for the days when the sums which are owing fall due."), gold-fever, the obsession with money as the only thing worth having.

This talk about how debts give power makes me think of the ancient Jewish tradition of the Jubilee, cancelling all debts to preserve society.

When there are debts there must be hoarded wealth.

Advance payment isn't interesting to Marx because it doesn't create the same class inequality as deferred payment does.

We saw earlier how

Tension between:

When [B] gets out-of-control, there is a "monetary famine". Everybody wants money. Some people hoard it away.

*"If we now consider the total amount of money in circulation during a given period, we find that, for any given turnover rate of the medium of circulation and the means of payment, it is equal to the sum of prices to be realized, plus the sum of the payments falling due, minus the payments which balance each other out, and, finally, minus the number of circuits in which the same piece of coin serves alternately as medium of circulation and means of payment."

This paragraph sounds harder than it is:

Quantity of money =

We had said that the quantity of money in circulation was the amount that covers the trade transactions of a day, but that was before we looked at deferred payments. "Money which represents commodities long since withdrawn from circulation continues to circulate. Commodities circulate, but their equivalent in money does not appear until some future date.

"Moreover, the debts contracted each day, and the payments falling due on the same day, are entirely incommensurable magnitudes." i.e. the bank loans out $x and receives due payments of $y on a given day, they're not the same. Contracts are made on a given day and have no impact on (and are not impacted by) the quantity of circulating money that day.

"Credit-money springs directly out of the function of money as a means of payment" – Here Marx moves beyond commodity-money to credit-money.

"certificates of debts owing for already purchased commodities themselves circulate for the purpose of transferring those debts to others." – simple enough: I owe Peter £10 so I give him an IOU signed by Paul for £10

"On the other hand, the function of money as a means of payment undergoes expansion in proportion as the system of credit itself expands. As the means of payment money takes on its own peculiar forms of existence, in which it inhabits the sphere of large-scale commercial transactions. Gold and silver coin, on the other hand, are mostly relegated to the sphere of retail trade" – So after spending about 100 pages with commodity-money, now credit-money (complex financial instruments, things banks do) is suddenly bigger and more important.

Money is the universal form of wealth, "the universal material of contracts", less and less to do with buying and selling useful things.

"Rent, taxes and so on are transformed from payments in kind to payments in money."

Marx says governments should take (some) taxes in kind (mostly grain probably) to prevent money being too all-consuming.

If debts are due on some day (e.g. tax day) there will be a run on the banks.

If payments are made yearly, money will have to be hoarded 12 times longer than if they are made monthly. This slows the velocity of money and therefore increases the quantity required.

"While hoarding, considered as an independent form of self-enrichment, vanishes with the advance of bourgeois society [die bürgerliche Gesellschaft], it grows at the same time in the form of the accumulation of a reserve fund of the means of payment." – in other words, when the financial system is sophisticated, you don't hoard gold to become rich (you do things with debt, credit, etc.), but people like tenants and students with loans must do their share of hoarding.

Tokens vary from country to country; gold and silver are good for global trade.

Mercantile system: after trade deficits between nations are calculated, they are settled in gold or silver. Marx agrees with them on this point (international transfers are for balance-of-trade) and criticises (in footnote 60) those who said international transfers are to take advantage of different prices of bullion.

Each nation needs its national bullion reserve to take care of these transfers.

Gold and silver go from countries with mines to countries with commodities people buy. It also flows internationally on the market.

"Countries with developed bourgeois production limit the hoards concentrated in the strong rooms of the banks to the minimum required for the performance of their specific functions [These different functions can come dangerously into conflict whenever gold and silver have also to serve as a fund for the conversion of bank notes]. Whenever these hoards are strikingly above their average level, this is, with some exceptions, an indication of stagnation in the circulation of commodities"

It's more economically stimulating to lend or trade excess gold and silver than leave them sitting there