this post was submitted on 25 Jan 2024

948 points (99.1% liked)

People Twitter

5189 readers

2074 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying or international politcs

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

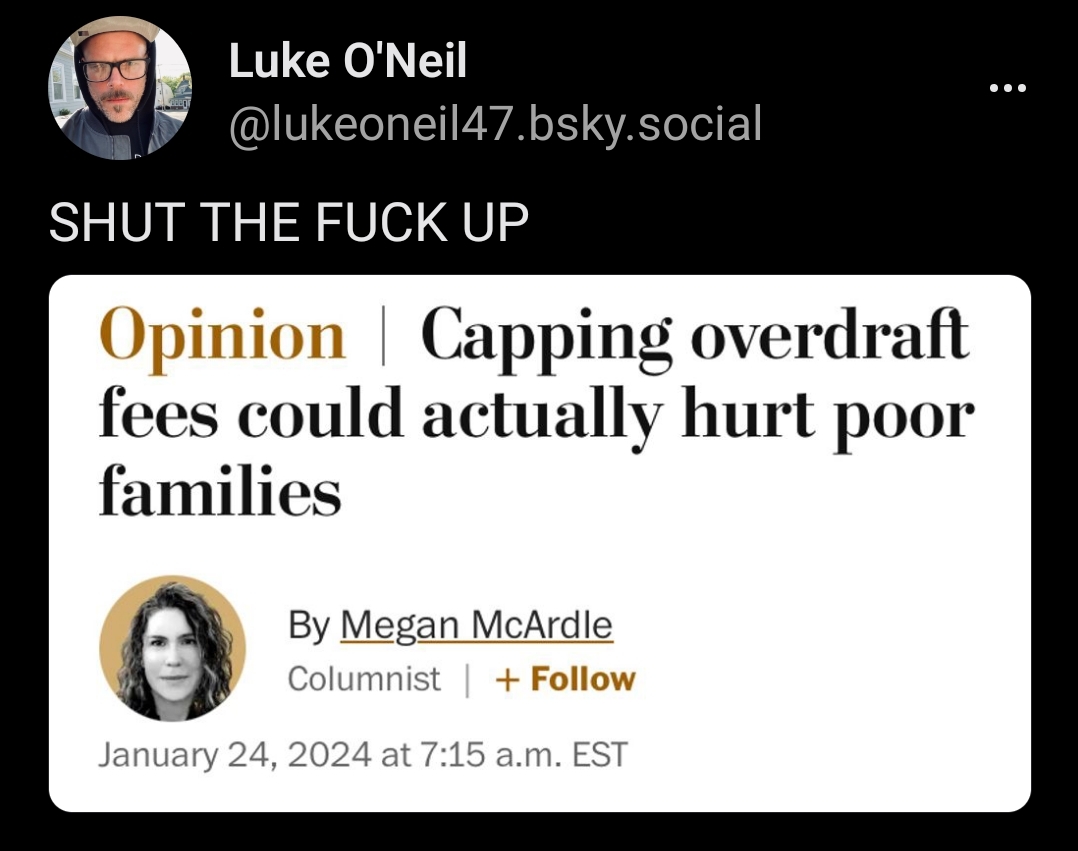

https://www.washingtonpost.com/opinions/2024/01/24/cap-overdraft-fees-hurt-poor-families/#

Here’s the article.

plaintext

These people are far and away the heaviest users of bank overdrafts. The Financial Health Network, a personal finance nonprofit, says the group most likely to overdraft includes “financially vulnerable” households that struggle to pay their bills every month and typically make less than $30,000 a year. Almost half of financially vulnerable households with checking accounts overdrafted in 2022, and of that group, two-thirds overdrafted at least three times, one-third did so six or more times, and one-fifth overdrafted 10 times or more. With an average overdraft fee of $26.61, hundreds of dollars in fees can land on the most cash-strapped customers. Capping those fees — possibly as low as $3 — would be a huge boon to families who really need the help. Who could oppose that?

Well, as with any nice-sounding policy, it’s important to consider the alternatives, both for the customer and for the banker.

For depositors, overdraft fees can be an expensive alternative to even worse options, such as payday loans or having their electricity shut off (and paying a reconnection fee to turn it back on). And “the best of bad alternatives” can also be sort of true for bankers, who must find some way to defray the cost of providing what is basically an unsecured loan to people who are, as we’ve seen, often financially struggling and might be unable to repay the money. The fees also help pay for “free” checking (which costs banks quite a bit of money to provide).

If we cap overdraft fees, how will banks make up the lost revenue?

From profits, you say, and fair enough, but Patrick McKenzie, who writes the Bits About Money newsletter, points out that the reason your bank is so obsessed with getting you to sign up for paperless statements is that the profit margins on checking accounts are so thin, they can be meaningfully improved by saving the cost of 12 stamps a year. “Margins on small bank accounts are very thin,” he wrote recently, and “credit losses can easily be larger than several years of them.”

Now the government wants to make those accounts even less profitable. It seems possible banks would look to limit their losses by getting rid of those customers or making up the revenue somewhere else — or possibly both. This seems to have happened in the past, judging from what we saw when federal regulators preempted some state fee caps in 2001. According to researchers from the New York Fed, the exempted banks both raised overdraft fees and expanded available overdraft credit, while lowering minimum balance requirements. The rate at which checks were returned for insufficient funds declined by 15 percent. And the share of low-income households with a bank account rose by 10 percent, suggesting that minimum balance requirements had kept those households from opening accounts.

That doesn’t mean that no one would benefit from this rule. High overdraft fees can also deter people from opening a bank account, and it’s possible that effect would outweigh any contraction of credit. The financial industry has also changed a lot since 2001, with nonbank alternatives, such as Cash App, that might offer the marginal bank customer a better replacement than an old-fashioned check-cashing store. But there would still likely be winners and losers, and I don’t know whether the former’s gains would outweigh the latter’s losses. I’m not sure the administration does, either.

Won't somebody think of the bankers! They hardly make any money at all on your broke ass $16.42 balance account!

it's only a problem if you see the banks as only a profit source and not as a service.

We had to force corps / government to give us days off, Healthcare, voting, not being slaves, electricity, water, internet... all things they wanted to be products and not services

Yeah, you don't make a huge amount of money on a service that everyone needs - boo fucking hoo, close the business and get a real job and stop eating avocado toast.

"You start nailing one white banker per week to a big wooden cross, you’re going to see that drug traffic begin to slow down pretty fucking quick."

What's this from?

Carlin

Truly one of the dumbest articles that I have seen.

Having any margin at all on a checking account is just gravy for a bank. It is not their primary source of revenue and never has been. Checking accounts are a mechanism to get customers to do business with them. It’s a marketing/advertising program, that has become required in the industry.

Bank’s are only interested in loans and deposits. This is where banks make the bulk of their money.

When it comes to the poorest people in society, they are not depositing much money or taking out loans. Bankers see them as freeloaders on a system designed to draw in people with more money. They can’t outright deny to service them without a marketing disaster so they punish them instead. Taking money from them to help defray the cost of their marketing efforts. Instead of just denying the charge for insufficient funds as they ethically should, they created an elaborate fee system to bleed money from them.

This is why you should always deny the overdraft protection on any checking account. Never let them charge you a fee for a charge they should have rejected.

If banks lose profit, they leave that customer group.

I always wonder why it is like a given that they have to make a certain amount each year or else. What would be so bad if they just made a little less?

I think I killed some brain cells reading this article, but I'm glad you posted it, thank you!

No problem.

Paywalled. Open in incognito.

Their point is that poor people use overdrafting instead of making actual loans. Removing the overdraft revenue from banks would make banks not offer it, making it necessary for poor people to take worse loans.

It's just an opinion piece and the author admits that it could have other results.