this post was submitted on 14 Jan 2024

661 points (98.2% liked)

People Twitter

5268 readers

1343 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying or international politcs

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

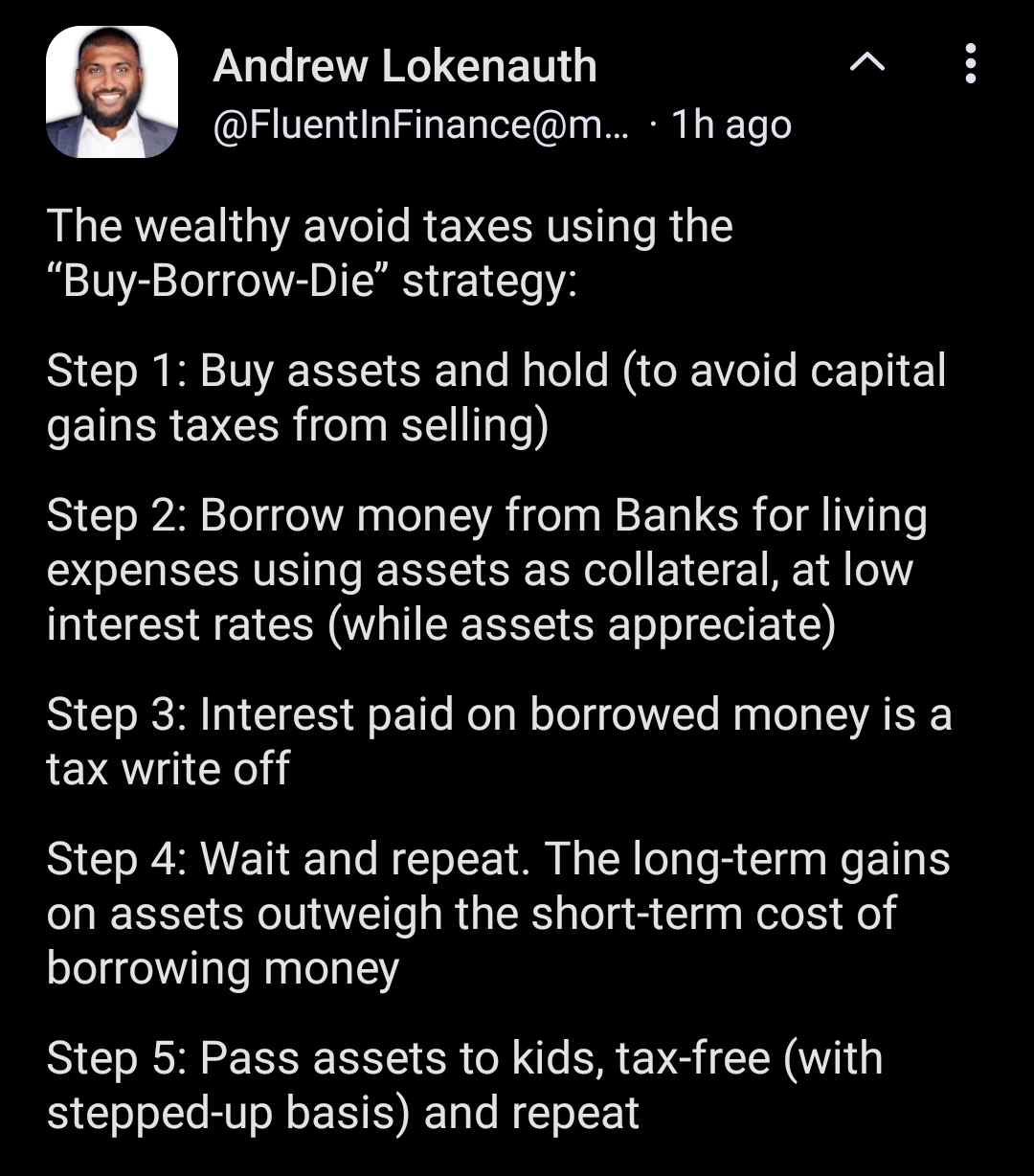

Yeah this is definitely missing a step somewhere. The loans have to be paid off even if you're dead. Before your kids get anything your assets are used to pay off your debts. Unless there's a loophole in there where the kids can assume the debts and somehow get the assets tax free, then this post doesn't make sense.

**Edit: Ah ok the loophole is in allowing the heirs to use step up basis when inheriting the assets. The whole lifetime gains on the assets goes untaxed.

Yeah that's a big loophole.

Debts will also only get paid out of their estate and never transferred on to kids or family unless it is using a joint account or the inheritors explicitly accept it. If they transfer the assets before they die, then die with 0 assets and a ton of debt, the debt just disappears (as far as their family is concerned).

Unless I am understanding that loophole wrong.