this post was submitted on 11 Jan 2024

422 points (84.8% liked)

People Twitter

5520 readers

981 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

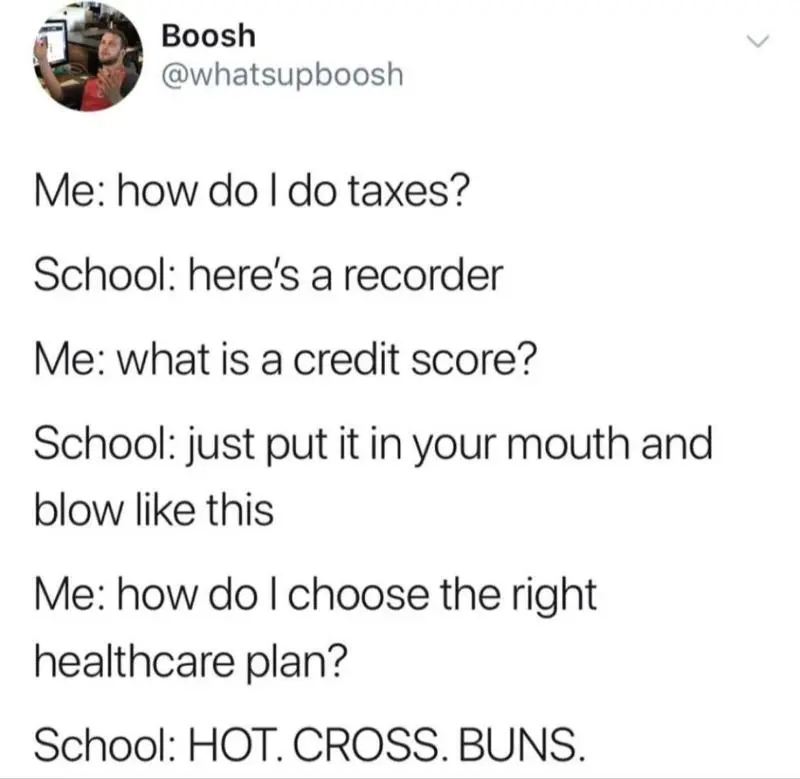

Yes I'm from the US and yes it IS easy for most people who can file a 1040 EZ. IF you have to file long form it is marginally more complicated I will grant you, but it's still read and follow directions. There is still micro economics on the menu if you want more of the finer points of personal finance BUT that is an aside and you still don't need a PhD to fill out a tax form.

It would of course be great if the government just eliminated or greatly reduced the tax filing process like other countries which as you say is the result of lobbying. HOWEVER. The education that is needed is not "how do I fill out my tax form", but instead "how do lobbies and special interest groups ruin my life as a result of unfettered capitalism, and how can I help fix that problem".

For a kid who has never filled out a government document before, tax forms can be daunting. Yes, it's easy to fill out if you know what you're doing - but I STILL get worried that I missed something because there are so many boxes I don't need to fill out and I've been doing it for 20+ years. Writing a resume is easier than filling out a tax form and they get taught the basics of that.

So I stand by that high schoolers should be taking life skills classes that include a lessons on filing taxes to get them more comfortable with it. There's a ton of stuff that they're currently taught that's significantly easier AND less relevant to their lives

Having worked for the government, that feeling doesn't go away for any government forms where there's a stiff penalty for doing it wrong.

I don't know what you cut because there is already so much and not everyone uses the same stuff: I use the Pythagorean theorem and quadratic formula and basic trig and all the other stuff people complain about when they don't do stem. Broad and general basics are about the best you can hope for I think.

Taxes are a certainty for sure, but any time you don't know what to do there are instructions to reread or internet to consult. I will also admit that I pay a CPA to do it after 18 or so years doing it myself: the filing part is simple enough, but knowing how the code changed so I can minimize tax expense for the next year is work.