this post was submitted on 11 Jan 2024

422 points (84.8% liked)

People Twitter

5383 readers

742 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

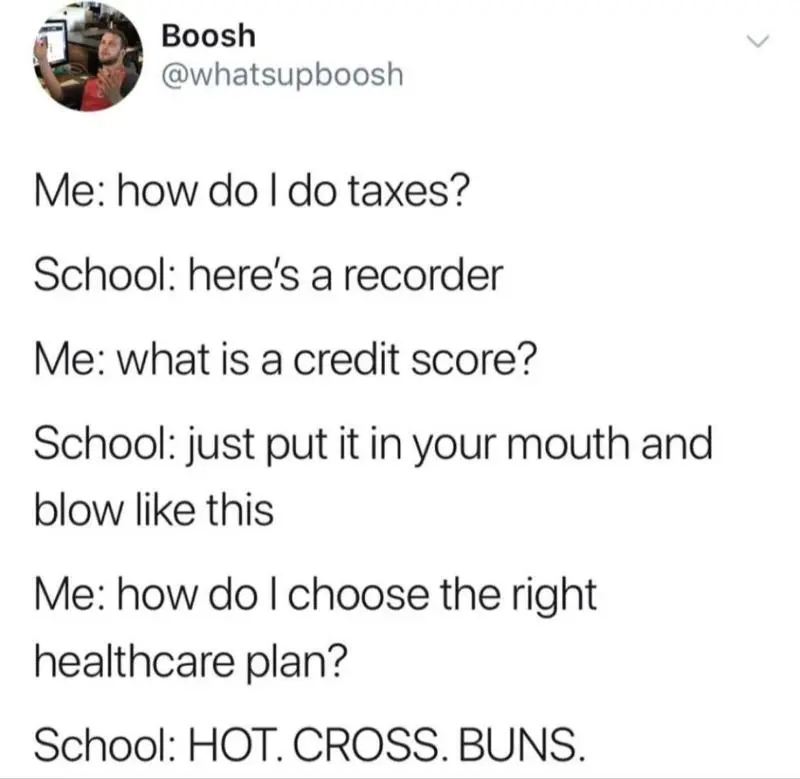

Let’s say I’m married filing separately with a mortgage, student loans, on my wife’s insurance but with my own job where I pay for a Flexible spending account for diabetes supplies. My wife also has student loans, some federal, some private. Let’s say we have a kid and pay for daycare but wife missed open enrollment for dependent care spending account. Maybe we even have our employer cover part of daycare in this scenario, let’s say 25%, but it didn’t kick in until 4 months into the year. Just for fun maybe one of us cashed out an old retirement.

How confident are you that you could handle that situation if you had only gotten a “remedial” education? This is not a super unique scenario even.

Pretty confident, because there are instructions for everything, and there are free web based filing systems that will ask you those questions, and put the values in the correct spots. Free Tax Act is one such application. But what you described is far from an average person, filing an average claim. Many of those circumstances are unique.

Free Tax Act is great for filing jointly or as a single person. It absolutely will let you fail extremely hard if you file separately.

Edit: this might not be true I used free tax USA.

Just want to sneak in I admire your faith in people’s ability, whether I agree with it or not.

Oop! Free Tax USA is the one I was thinking of too.

Hehe. Thanks (I think). I have been accused of over-estimating people's competence on more than one occasion, so I concede that it's entirely possible that I'm wrong about this subject.