this post was submitted on 27 Dec 2023

837 points (97.5% liked)

memes

10197 readers

2230 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

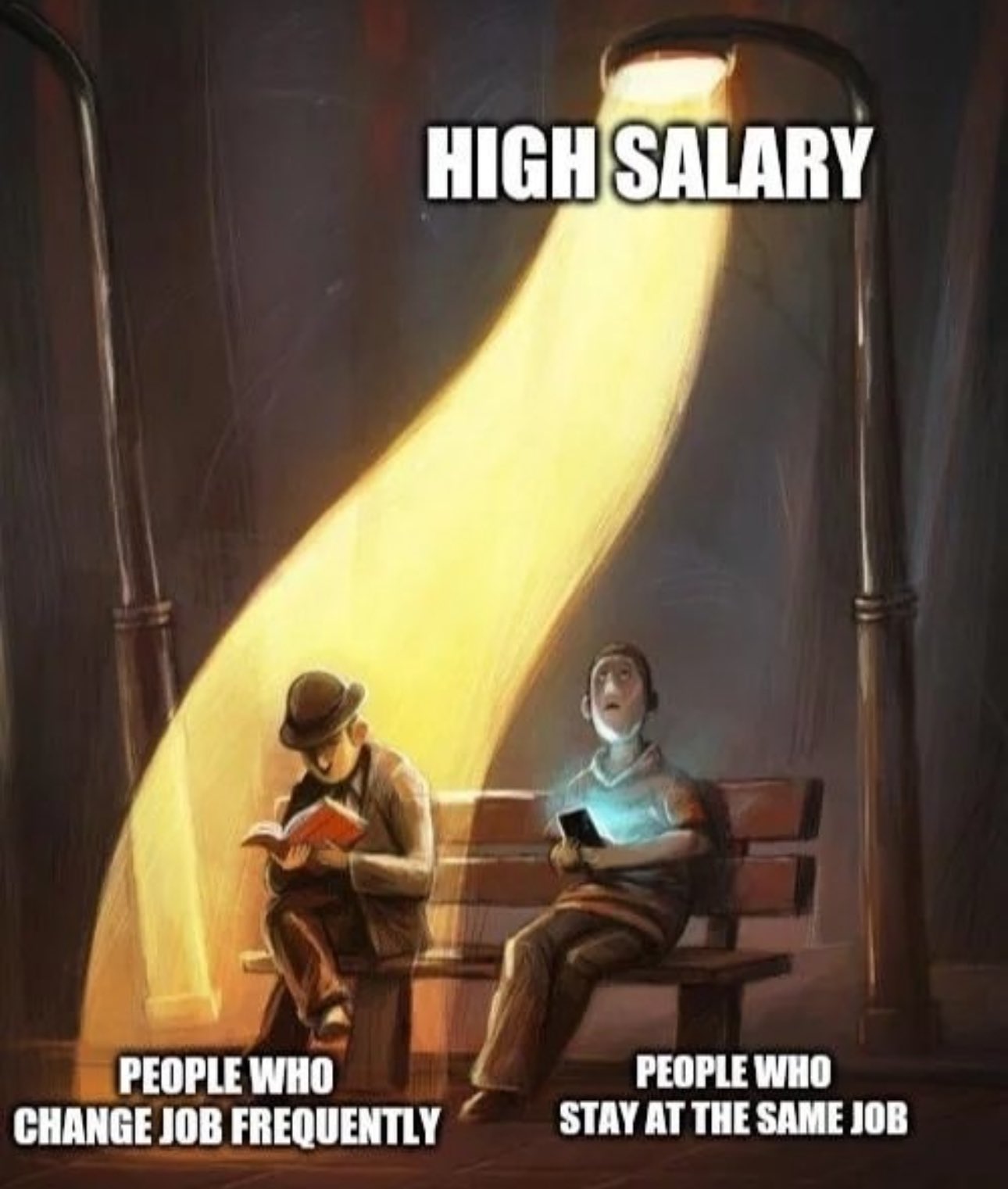

I think the idea is that more employers are being cautious right now, and so employees lose a bit of leverage going into negotiations. They'd rather wait with what they have, some sense of stability, and enter the job market again when things are looking better for the employees.

Is this necessarily true or accurate? I don't really know, that's a bit outside of my pay grade, but I get the reasoning

The thing is, while interest rates and wages are in some ways connected, it's a far less direct connection than simply taking a look at the overall labor market, competitive pay rates for your skills, and going job hunting when yours isn't keeping up.

Regardless of interest rates, the labor market is tight right now, which means better offers from those companies willing to compete for qualified workers, end of story.

Honestly, while I'm no economist, I would think that most companies aren't borrowing in order to cover payroll, so while interest rates may affect their decisions in regards to capital investments, they only have a tangential effect on hiring and compensation offers. In fact if anything, maybe a high interest rate might dissuade a company from capital investment and steer them toward a focus on staffing.