this post was submitted on 14 Sep 2023

8 points (100.0% liked)

Finance

2278 readers

4 users here now

Economic and financial news from around the world, including cryptocurrency and blockchain.

This community's icon was made by Aaron Schneider, under the CC-BY-NC-SA 4.0 license.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

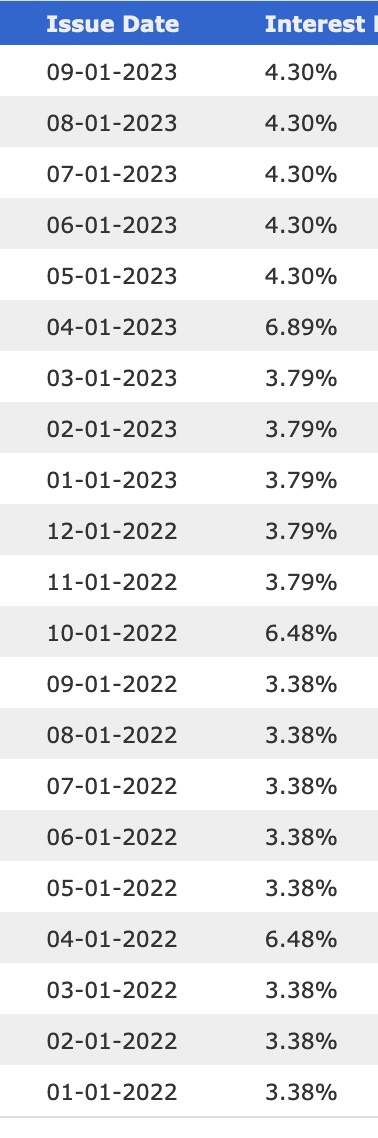

Hi OP. The “inflation” component of an I-Bonds interest rate adjusts every six months. Your April and October bonds are still using the old “inflation” rates. They’ll fall in line at the beginning of next month when they adjust to the current rates. Simultaneously, you’ll also see the May and November I-Bonds adjust to newer rates.

Of course I just happened to look at my account when there was only one "tranche" of bonds that hadn't adjusted and it looked like there was a weird pattern going on. Thanks for clarifying!