this post was submitted on 17 Jan 2024

123 points (100.0% liked)

politics

21944 readers

1 users here now

Protests, dual power, and even electoralism.

Labour and union posts go to [email protected].

Take the dunks to /c/strugglesession or [email protected].

[email protected] is good for shitposting.

Do not post direct links to reactionary sites.

Off topic posts will be removed.

Follow the Hexbear Code of Conduct and remember we're all comrades here.

founded 4 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Article with more info here

Presumably "actual cost" means the literal mechanical requirements for the system e.g. the electricity and server power to detect the overdraft and send the credit. I can't imagine that being very much at all, in the neighborhood of a couple cents. Conveniently, I can't find any data on this—any search involving "overdraft" and "cost" gives me SEO vomit about what the banks charge, not what it costs them.

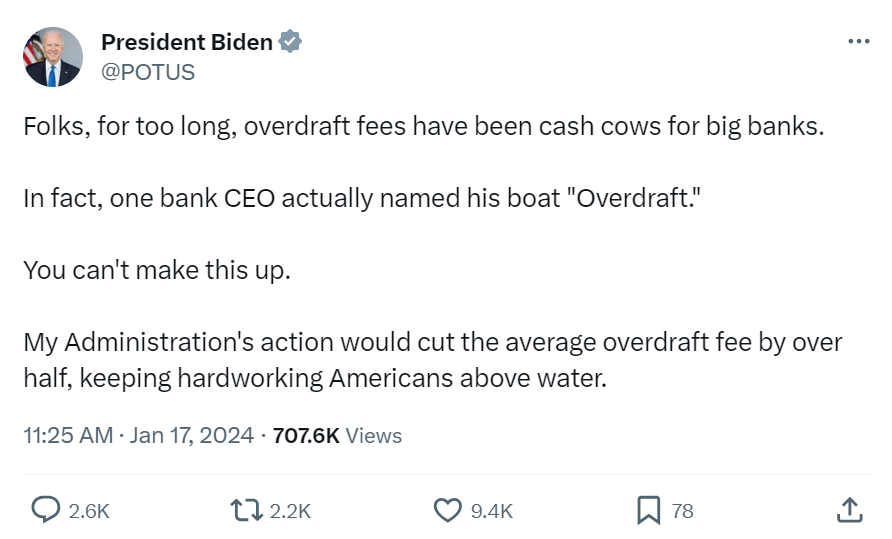

So Brandon's okay with exploitation (charging hundreds times more than the actual of cost the service) as long as it's not over a certain arbitrary threshold to start. Because you just know the banks are gonna weasel that back up to $25 or something like that.

Based on that last sentence, it sounds like the agency can do whatever it wants here, except...

Can't wait for these regulators to get bribed. Or failing that, for unelected jerkoffs to decide it's illegal not to exploit people, actually.

Honedtly that seems fine! You don't get charged $35 for a $2 overdraft, and it's consistent with the bank's other service of loaning money for interest.

Which is like a fraction of cent at most.

Yeah I was being generous with a couple of cents, especially since even without overdraft they would have the mechanism for detecting an account not having enough to cover a transaction.