this post was submitted on 14 Jun 2024

1447 points (99.2% liked)

Political Memes

5505 readers

1778 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

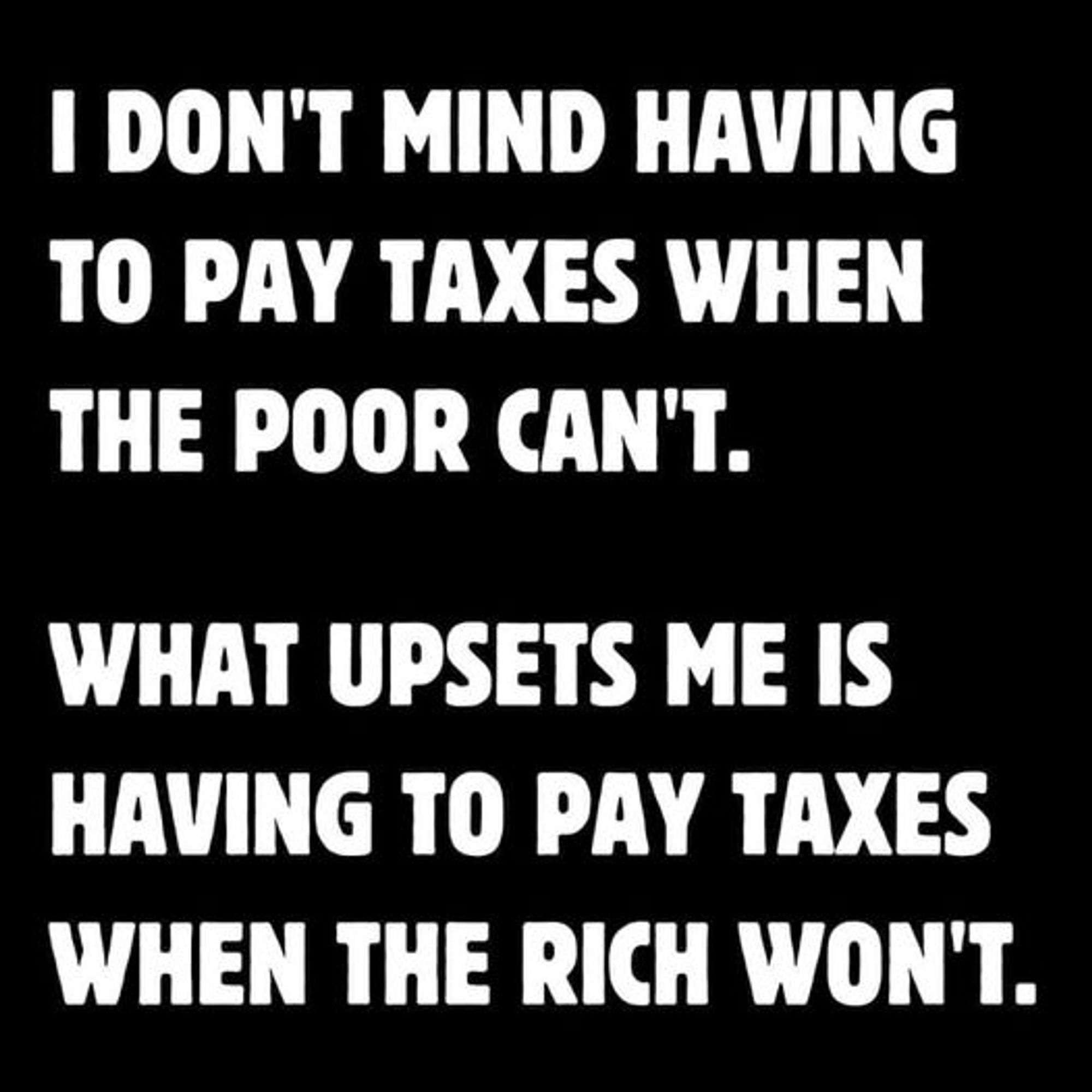

I've posted this before and next time it comes up I'll probably post it again,

Way it should be in my eyes,

Set the brackets at calculated thresholds for the 20th percentile, 40th percentile, 60th percentile, 80th percentile, 95th percentile, and 99th percentiles of incomes.

And just to turn the dial up even more, find the median income in the 20% bracket, and apply just the teensiest percent multiplier to the nominal rate for every time someone's income tips over another twenty times that median

Doesn't just keep tax rates dynamic to reflect the economy, it also ramps up the pressure extremely quickly against wealth accumulation, and suddenly inclines the rich to start eating each other, because now they're all in direct competition to have the most while cutting each other all down to avoid their tax rates spiking, and since it's a flat multiplier instead of a more complex formula, those 99 percenters can get titanically screwed by actually losing money for getting too much, since anything above a third of the nation's wealth means they're paying a dollar and change for every dollar they make. They'll become each other's worst enemies since anyone who starts hording raises the tax pressure on everyone else.

Oh and just to make sure it stays that way, anyone who peaks the 99% club, you are officially acknowledged as "doing well and good enough", and are barred from public office for the next ten years following the last time you pay in that bracket. Just picture it, a government with no one percenters in it, and instead of trying to lobby their way back in they're all too busy trying to tear each other down for a decimal point off their nominal rate.

I just want to say implementing a mathematical function is far more convenient then using brackets. That way you can make sure anybody who gets a raise also gets to keep more, but pays more taxes at the same time. Because you will never jump a bracket which reduces your income because of higher taxes. The other benefit is, that you can easily implement a negative income tax. This would make sure that anybody who is working, has more income than people who don't work. This would be an incentive for anybody to work what they can, even if it is very little.

Thats not how the tax brackets work. Only the amount that is in that bracket is taxed at that rate. What can happen is a loss of income based social services and tax breaks for lower income families.

You are obviously right. I always mix this up (see Bracket creep why I mix this up). But otherwise my point still stands. In this stackexchange is a graph with an example how tax brackets turn out at each income. My actual point ist, that the graph is not smooth and I don't like that. Also there is a highest bracket, which will allows the super rich to keem growing their wealth. The fact, that super rich people are hiding their actual wealth for example via credits, is a separate issue, which obviously can't be tackled by income tax alone.

Fair yeah, the system needs reform