this post was submitted on 14 Jun 2024

1447 points (99.2% liked)

Political Memes

5431 readers

2758 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

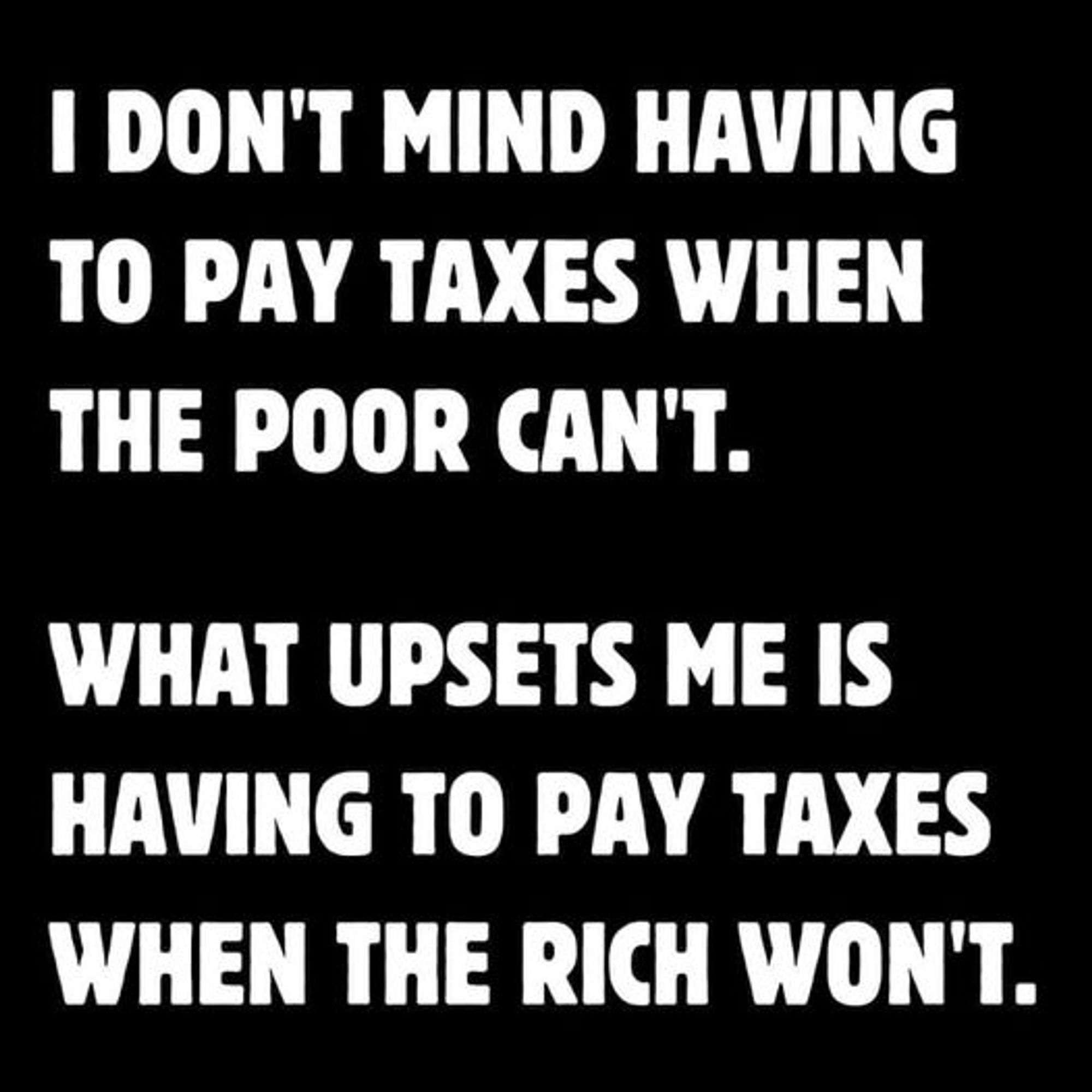

Thats not how the tax brackets work. Only the amount that is in that bracket is taxed at that rate. What can happen is a loss of income based social services and tax breaks for lower income families.

You are obviously right. I always mix this up (see Bracket creep why I mix this up). But otherwise my point still stands. In this stackexchange is a graph with an example how tax brackets turn out at each income. My actual point ist, that the graph is not smooth and I don't like that. Also there is a highest bracket, which will allows the super rich to keem growing their wealth. The fact, that super rich people are hiding their actual wealth for example via credits, is a separate issue, which obviously can't be tackled by income tax alone.

Fair yeah, the system needs reform